(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

Markets in February 2022

What happened in February?

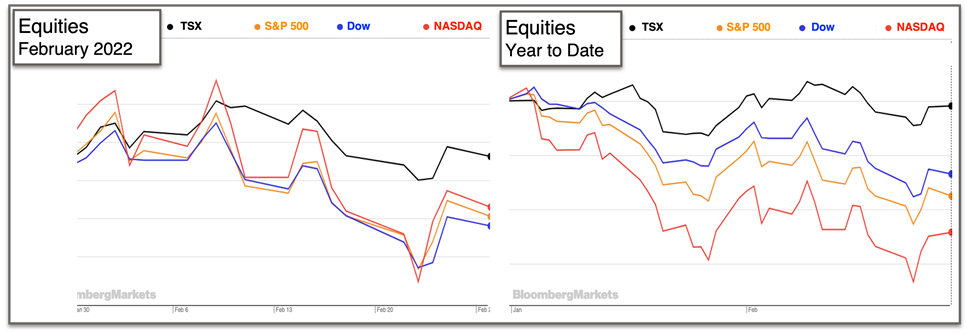

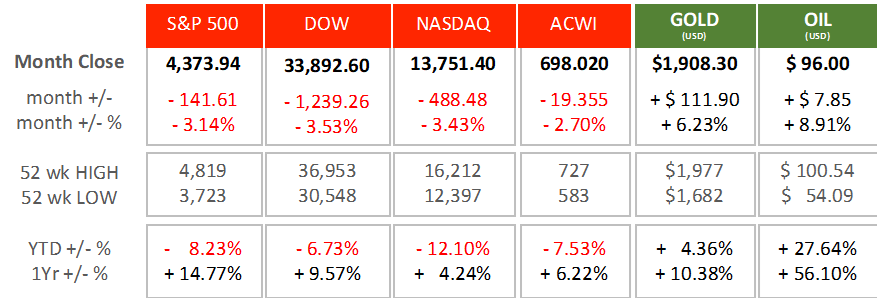

Equity markets started out the month with a nice rebound from the steep pullback experienced in January. However, once the Russian invasion of Ukraine broke out, we saw a return to the downward trend.

Year-to-Date shows the TSX on a much better footing than south of the boarder, due to our economy being heavily weighted in banks and oil & natural gas. The S&P 500 has outperformed the NASDAQ due to tech’s high stock valuations being hit by the prospects of interest rate increases and monetary policy tightening.

We saw some encouraging U.S. Job numbers, with an addition of 467,000 jobs in January but the country is still 1.7 million jobs below pre-pandemic levels. Labour Force Participation (the number of employed people plus those seeking employment) being the main dragging factor. BLS source

In Canada, we have held out better on the job front than the US, with already fully recovered employment levels. We took a hit of 200,000 jobs in the hospitality and food service sectors in January because of Omicron, but these should return swiftly through reopening. Statscan source

On the inflation front, it has been accelerating with a year-over-year U.S consumer inflation increase in January from 0.6% to 7.5%. Inflation sits at its highest level in forty years. Core inflation, which excludes the volatile consumer categories, food and energy, grew to 6.0%. In Canada, the year-over-year inflation increase has been 5.1%, highest in 30 years. This is making a strong case for the North American Central Banks to increase interest rates throughout 2022, and as such the Bank of Canada raised their benchmark interest rate this morning (March 2nd) to 0.5%. https://www.bls.gov/news.release/cpi.nr0.htm

Regarding the Russian invasion, the response has been as follows:

- Governing bodies, like the United Nations, have condemned Russia’s breach of international law

- Russia’s relations with the global community, except for countries in its inner circle, are being severed diplomatically

- Trade embargos and flight bans are limiting international sales of Russian products and services

- Russia is being cut-off from the global payments network, SWIFT, preventing flow of capital

- Travel restrictions have been imposed on Russian airlines and citizens

- 500,000 refugees have fled westward from Ukraine, and the U.N. is preparing for 5 million in total

- Assets of the Russian Federation and its citizens held in foreign banks are being seized

- Russian sports teams are being disqualified from European and global events, like the World Cup.

To sum up the financial effects, it has been as follows:

- The invasion has impacted almost every country and their capital markets

- Europe is dependent on Russia for oil and natural gas, receiving about 40% and 25%, respectively, of these two energy types. Also, Russia and Ukraine together account for nearly one-third of global wheat exports. Because of these factors, the invasion has caused the already high price of commodities to continue climbing, notably:

- Oil reached $110 per barrel, after rising more than 11% since February 25th. Oil price could be offset by the 60 million barrels of strategic oil reserves that will be released to contain the rapid increase

- Aluminum hit a record high

- Silver prices have jumped 10%

- Gold has increased $100 per ounce in the last month

- Traditional “safe haven” investments have also increased in value and volume:

- A rush into bonds has given their price a bump, lowering yields

- The U.S. dollar has strengthened against the Euro, Pound, Canadian dollar and many other currencies

- The Moscow stock market closed for its second consecutive day on March 1st to prevent a sell-off

- Russian firms, like Gazprom, that trade internationally have lost 20-50% of their value and several exchanges have halted trading in Russia-based firms

- The Russian Ruble has lost about 40% of its value against the U.S. dollar as of mid-morning on March 1st

What’s ahead for March and beyond?

The Russian invasion and central bank monetary policy shift will be the overlying themes for markets moving into March.

The effect on the global economy from the Russian invasion will continue to develop. Limiting the free flow of goods, services, labor, and capital to-and-from Russia will lower economic output for Russia and any countries that cannot replace the restricted economic activity. However, most of the burden will be felt by Russia if sanctions deliver the intended results.

The shortening of supply, especially in oil and natural gas, is predicted to lead to increased inflation and subsequently potential larger actions to contain price increases by central banks through raising interest rates and quantitative tightening.

The markets will be looking for pivoting statements at these key events:

- Today (March 2nd), the Bank of Canada announces monetary policy updates

- March 10th, the ECB (European Central Bank) meets

- March 16th, the Federal Reserve releases its latest interest rate guidance

Bottom Line:

We are still in a period of market uncertainty. The underlying headwinds going into 2022 are still in play and we have a military conflict to add to it. We should expect market volatility going forward but must stay patient with our investments while continuing to focus on our long-term financial goals. These uncertainties will eventually play themselves out and the elements of quality investments and diversification will continue to show resilience in your portfolio in the interim. Corrections often act as a market “cleaning agent” to help curb wild speculation in asset prices and help us return to a healthy upward trend once things stabilize. If you have any question or concerns, please reach out to a member of the Qopia Financial team.

Aligned Capital Partners Inc. (“ACPI”) is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and Investment Industry Regulatory Organization of Canada (“IIROC”). Investment services are provided through Qopia Investments, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/Qopia Investments and covered by the CIPF. Financial planning and insurance services are provided through Qopia Investments. Qopia Financial is an independent company separate and distinct from ACPI/ Qopia Investments.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments