Last Month in the Markets: March 1st – 29th, 2024

What happened in March?

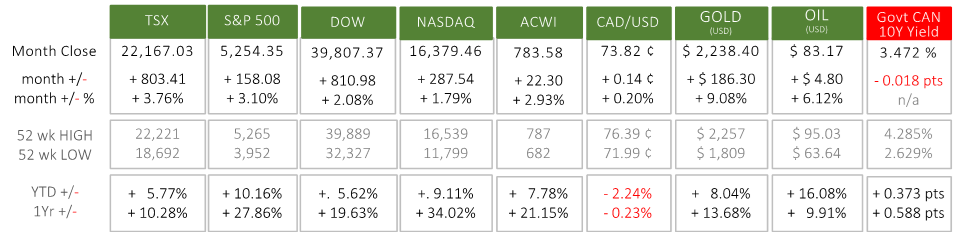

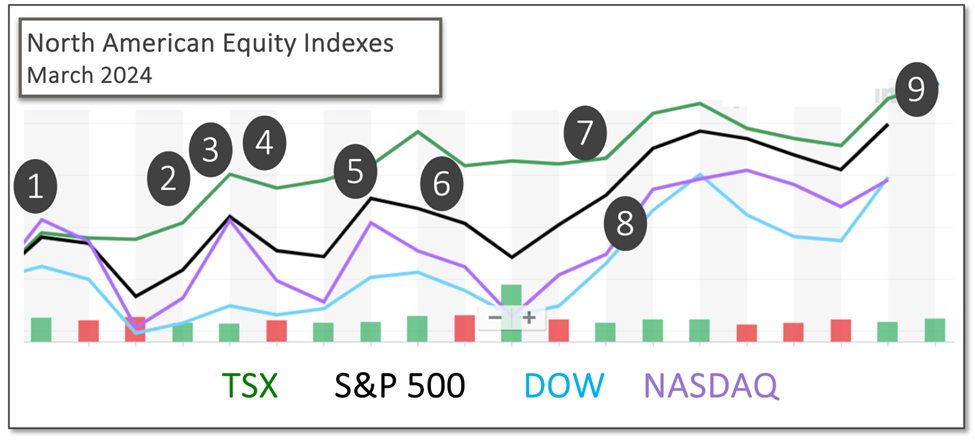

March saw another positive month across the board for global risk assets, as the expectation of a coming soft-landing continued. February’s theme of broadening market participation in the uptrend was also extended in the US. The small cap index, the Russell 2000, outperformed the S&P 500, up 3.6% and 3.2% respectively, and with both if these diversified indexes outperformed the technology focused Nasdaq, up only 1.8%. Canada outperformed the US, with the TSX finishing off at 3.76% and international Markets kept pace with developed Europe and Asia, being represented by the MSCI EAFE index, returning 3.4%. The most notable region this month was the UK, with equities up 4.5% on the prospect of rate cuts. wsj

Commodities have also seen notable gains recently, as expectations in global growth have started to revive. The Global Manufacturing PMI report for March showed a tentative improvement as it inched above the expansionary number of 50 for the first time since August 2022. Gold provided an abnormally large monthly return at just over 9%, with substantial purchases by Russia, China, India, and other central banks, heightened geopolitical uncertainty, and the prospect of interest rate reductions, while the level of inflationary pressure is still uncertain. Oil also had a healthy return because of improved manufacturing data, geopolitical tensions, and a tightening crude supply. US Global reuters ismworld

Here are the highlights of the month:

- March 1st

March began positively after the Bureau of Economic Analysis released the Federal Reserve’s preferred inflation indicator and the Personal Consumption Expenditures (PCE) price index. Inflation for January broadly met expectations and the major indexes continued their upward trajectory. The Dow, S&P 500 and NASDAQ have gained 20%, 30% and 40% over the past year, as of the beginning of the month. BEA PCE release

- March 6th

As expected, the Bank of Canada held its policy interest rate unchanged. The overnight rate remained at 5%, the Bank Rate is 5.25%, and the deposit rate is 5%. The release of January’s Canadian Consumer Price Index (CPI) showed it at 2.9%. “The Bank continues to expect inflation to remain close to 3% during the first half of this year before gradually easing”. Tiff Macklem, Bank of Canada Governor stated, “We don’t want inflation to get stuck, materially, above our target.” BoC release CBC and BoC

- March 7th

The European Central Bank (ECB) mirrored the Bank of Canada’s decision to keep policy interest rates unchanged. ECB staff project projects “inflation to average 2.3% in 2024, fall to 2.0% in 2025 and again to 1.9% in 2026.” ECB release

- March 8th

February’s 275,000 additional jobs is above the average monthly gain of 230,000 over that last year, according to the Bureau of Labor Statistics. Job gains were concentrated in health care, government and food services and drinking places, social assistance and transportation, and warehousing. The unemployment rate rose 0.2% to 3.9% as 334,000 more job seekers were unsuccessful and totalled 6.5 million, up by 500,000 over February 2023. BLS release CNBC and jobs

- March 12th

The Bureau of Labor Statistics reported that the U.S. Consumer Price Index rose 0.4% in February, up from January’s 0.3% rise. On a year-over-year basis, consumer prices have risen 3.2%. Shelter and gasoline contributed more than 60% of February’s one-month price inflation. BLS CPI release

- March 14th

The Producer Price Index (PPI) for final demand rose 0.6% in February after increasing 0.3% in January and decreasing 0.1% in December. On an unadjusted basis, the final demand index rose 1.6% over the past year, which is the largest increase since September 2023 when the PPI rose 1.8%. Much of the increase can be traced to the rise of the price of gasoline. BLS PPI release

- March 19th

Domestically, Canadian consumer inflation continues to moderate as the Consumer Price Index (CPI) rose 2.8% on a year-over-year basis in February, down from 2.9% in January. Groceries contributed to the small decline, while gasoline prices offset the dip after rising 0.8% for the month. The Bank of Canada has not indicated the timing of rate reductions. StatsCan release CBC and BoC

- March 20th

Two weeks after the Bank of Canada made its monetary policy announcement, the Federal Reserve also kept its rates unchanged. The Fed released its quarterly Summary of Economic Projections (SEP) that indicate interest rates are expected to be lowered in 2024, 2025 and 2026. Fed release, SEP, and press conf

January’s Labour Force Survey (LFS) from StatsCan showed that employment increased by 37,000 following three months with little change in total jobs. The unemployment rate fell 0.1% to 5.7%; the first decline in more than one year. StatsCan release CBC and LFS

- March 29th

Core US PCE, which excludes food and energy, sat at 2.8% year-over-year for February. Annualized inflation was unchanged from last month and is at its lowest level in nearly three years. The long-term goal of an average of 2% for core PCE has not been seen in more than three years. The Fed’s next interest rate announcement will occur on May 1st, when rates are expected to remain unchanged. The first interest rate reduction is anticipated to be June 12th according to CME’s FedWatch tool. BEA’s PCE release CNBC and PCE.

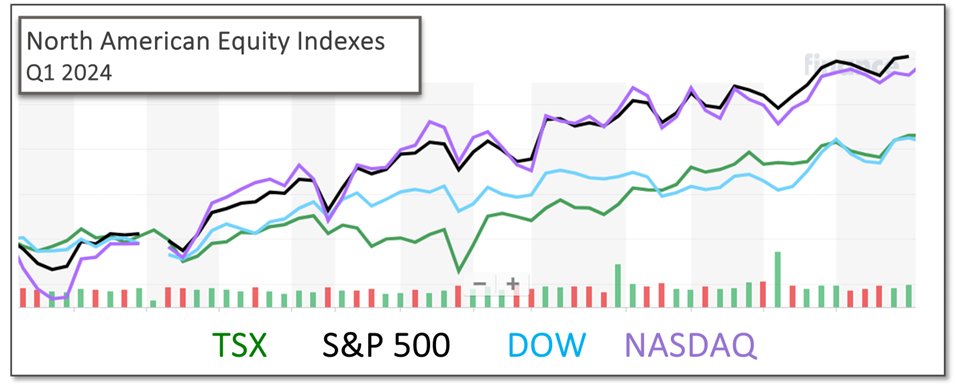

The first quarter (Q1) effectively concluded on March 28th. Market performance for Q1 is reflected in the YTD numbers on the initial table, landing in the range of 5 – 10%. The strong performance extends beyond North America as global equities, represented by the All-Country World Index (ACWI), delivered nearly 8% for Q1. These themes have continued throughout the quarter:

- The initially unexpected US economic resilience in the face of tightening monetary policy, which has been fueling corporate earning growth optimism and a belief of a soft landing. The Canadian Economy is showing less resilience than the US.

- While US inflation has been decreasing, but currently at 3.2%, it is having trouble going below 3%. The Fed has maintained it’s intention to cut interest rates 3 times over the course of the year despite this. This has provided relief to the markets that the Fed will be more dovish than originally thought, which has partially fueled the gains. In Canada, inflation is getting closer to target. The current 2.8% has been also mainly attributed to house prices. Excluding housing, inflation is below target, at 1.5%. Because of this, the market believes the Bank of Canada will cut rates before the Federal Reserve. realeconomy

- The US Employment situation remains an uncertain factor, while the labour market has been cooling since the start of the year, it remains tight. With a risk of it keeping inflation high or going into a downward recessionary spiral.

- Generative AI has continued to fuel upside in the technology and communication service sectors.

What’s ahead for April and beyond?

As we emerge from a long period of elevated inflation, the path of monetary policy will continue to heavily influence capital markets for the foreseeable future.

One of the major concerns in Canada is that reducing interest rates too soon could overheat the spring housing market, and further raise and extend on-going inflation. Inflation and its predictability have not concretely reached levels to facilitate a rate cut, and we will be also heavily influenced by U.S. monetary policy. CME FedWatch tool CBC and BoC rates BoC press conf excerpt BoC and housing

The economic forecast remains murky. Although there have been some bright spots since the year started, the long-term situation remains less certain, as there are lot of contradictory signals. For instance, while manufacturing seems to be improving, there is rising credit card delinquency rates. In reaction, Banks are raising credit card interest rates and curbing their willingness to increase credit balances and issue new cards. These are catalysts for consumption to decline. The rise in delinquency rates also a signal that pandemic savings have run out. We are also seeing this pattern from a slower growth in retail sales. As for inflation, price indexes continue to fluctuate, surprising both to the upside and downside in Canada and in the U.S.

In the short term, we could continue to see upside in equities if the Federal Reserve follows along with it’s rate cut expectations amid sticky above target inflation and a tight labour market. Likewise in Canada. Looking further out, dwindling savings, a cumulative impact of higher rates, and continuing geopolitical tensions, mixed with the current high expectations of the markets, shown by rich valuations, warrant keeping downside protection in our asset allocation. We have slightly dialed back on our defensive tilt by increasing our investments in commodities and duration, but we’re still prioritizing quality and retaining a degree of defensiveness in our strategy.

Luke Demjen is an Associate with Aligned Capital Partners Inc. (“ACPI”). The opinions expressed are those of the author and not necessarily those of ACPI. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. ACPI is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and the Canadian Investment Regulatory Organization (“CIRO”). Investment services are provided through Qopia Investments, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/Qopia Investments and covered by the CIPF.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments