Last Month in the Markets: October 1st – 31st, 2023

What happened in October?

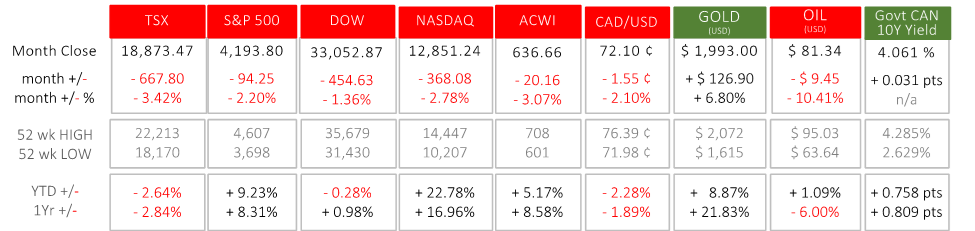

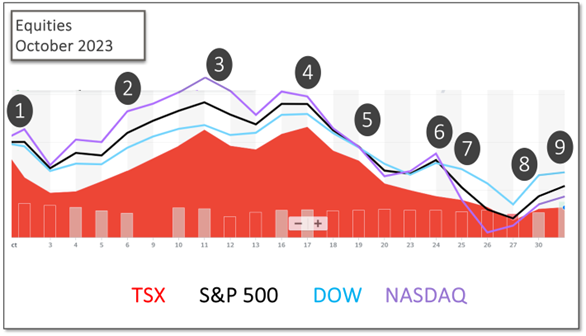

With a relief rally at the beginning of the month, October saw a continuation of September’s board-based sell off. Every asset class except for Canadian short- and medium-term bonds, gold, and cryptocurrency experienced a negative return over the month. The Canadian bond return was minimal, ending the month up less than 1%. Stronger than anticipated US economic data caused a rally in long term US and global bond yields, putting downward pressure on most bond prices globally. Higher debt servicing, caused by higher rates, put negative pressure on equities, with the S&P 500 breaking below it’s 200 day moving average and US 10-year bond yields testing 5%, a yield which hasn’t been seen since June 2007. CNBC

Defensive sectors outperformed. While US technology remained flat, Canadian consumer staples and US utilities where the sectors that squeezed out a positive monthly return. Ycharts

Despite the rise in geopolitical conflict over the course of the month, which normally puts upward pressure on the price of oil, it ended the month lower. This reflects investor sentiment that sluggish economic growth could weigh on demand. The conflicts did however reflect in the price of gold, which generated a return of 6.8%. The US dollar also appreciated, showing its status as a haven asset. This was extenuated by the depreciation of the Canadian dollar, due to lower oil prices and a slower expected inflation rate release on Oct 17th.

Here are the events that contributed to the choppy month:

September 30th / October 1st

As the month was beginning, a stop-gap measure that extends spending for an additional 45 days was found to avoid a U.S. government shutdown. CNBC and “shutdown”CNN and “shutdown”

October 6th

The U.S. Bureau of Labor Statistics reported a total nonfarm payroll employment rise of 336,000 in September, better than expected. The unemployment rate was unchanged at 3.8 percent. BLS release

October 11th and 12th

On the two consecutive days, U.S. producer and consumer inflation data sets were released. The Producer Price Index (PPI) increased 0.5% in September, down slightly from 0.7% in August. Year-over-year prices advanced 2.2%, which is the largest increase since April. Consumer prices rose 0.4% in September, down from 0.6% in August. Over the last 12 months the Consumer Price Index (CPI) has risen 3.7%, which is the same reading as in August. BLS PPI release BLS CPI release

October 17th

Canada’s CPI was lower than expected. On a year-over-year basis consumer prices rose 3.8% in September, slightly lower than the 4.0% gain measured in August. The slowing of price increases was led by travel serviced, durable goods, and groceries. Gasoline rose 7.5% on an annualized basis, compared to August’s 0.8% increase. Excluding gasoline, the CPI rose 3.7% in September. CBC and CPI StatsCan CPI release

October 18th to 23rd

The U.S. corporate earnings season began with disappointment. The number of positive earnings surprises and the magnitude of the earnings surprises were slightly below their 10-year averages. This is not what markets wanted. Factset and Q3 earnings

October 25th

The Bank of Canada made a monetary policy announcement that kept the policy interest rate unchanged. According to the press release, “Inflation has been easing in most economies, as supply bottlenecks resolve, and weaker demand relieves price pressures. However, with underlying inflation persisting, central banks continue to be vigilant.” BoC Press Release CBC and BoC

October 26th

U.S. GDP grew faster than expected during the third quarter. The annualized pace was 4.9%. The data showing the expanding economy and inflation above target increased the risk of the Federal Reserve continuing to raise interest rates. CNBC and GDP BEA release

October 27th

On Friday, the Bureau of Economic Analysis released the Personal Consumption and Expenditures (PCE) price index. In September, the most recent reporting period, personal income rose 0.3%, and the PCE price index rose 0.4%. Core PCE (excluding volatile food and energy) increased 3.7% on a year-over-year basis. Core PCE peaked at 5.6% in early 2022, and has fallen steadily, but remains well above the Fed’s target of 2%. The PCE is the Federal Reserve’s primary inflation indicator, which was a few days ahead of the next U.S. interest rate announcement. BEA and PCE CNBC and PCE

October 31st

According to StatsCan, real gross domestic product (GDP) was essentially unchanged for a second consecutive month in August as factors such as higher interest rates, inflation, forest fires and drought conditions continued to weigh on the economy. StatsCan release

What’s ahead for November and beyond in 2023?

On November 1st, the Federal Reserve announced that it was holding interest rates unchanged. The Federal Funds rate will remain in the range of 5.25% to 5.5%. At the proceeding press conference, Fed Chair Jerome Powell noted that rate reductions have not been considered or discussed yet and the committee is still questioning whether rates should be further increased or not. Despite these statements, the markets took Powell’s disposition as dovish and rallied into the first weekend of November. CNBC and Fed release Fed release and press conference

As we continue to see strong economic resilience in the US, the looming short-term question is whether this will cause further tightening. While the report on Oct 6th shows continued job creation, it is being colored by undertones of layoff notices increasing and full-time job creation over the last few months showing a contraction. This data does not provide a definitive conclusion on whether labor market conditions are loosening, which is a big factor for the Fed, but it does show signs tight monetary policy is taking effect on economic growth. Openicpsr

In Canada, we are showing much less economic resilience, with no GDP growth over the last 2 quarters. This gives a strong signal that tight monetary policy is having an effect, providing the probability that we have seen the last of the rate increases. StatsCan

Recessionary pressures are still prevalent going into 2024. While we might continue to experience periods of upswing, weak economic conditions will continue to put meaningful pressure on the chance of a sustainable increase in broad equity valuations over the medium term. Bonds, however, look appealing, as rates have reached a more than two decade high. We keep our stance as defensive and overweight quality fixed income.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments