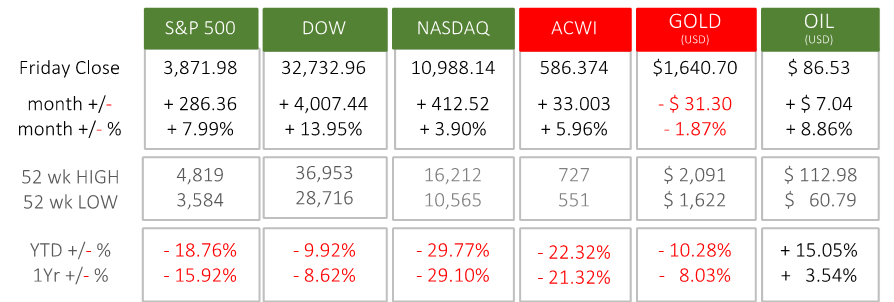

Last Month in the Markets – October 3rd – 31st, 2022

What happened in October?

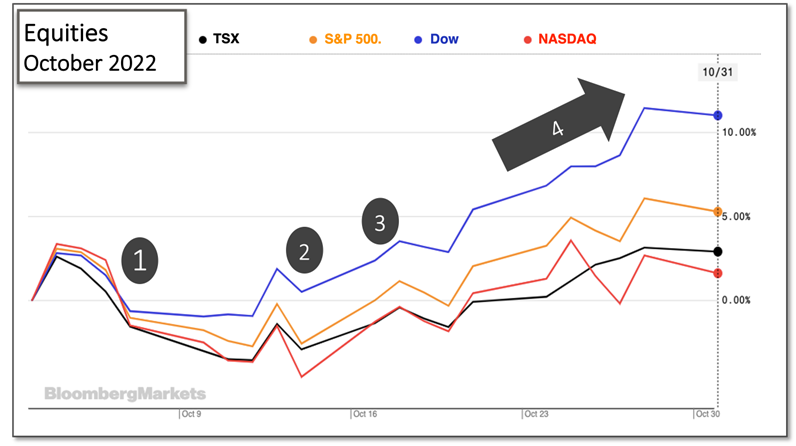

The beginning of the month was choppy for equity markets, with a rebound leading to a sharp pull back mid month. The broad-based indexes, the TSX and S&P 500, were flat after these swings, while the Dow and NASDAQ had lost 3.2% and 2.4%, respectively.

Since the close of markets on October 14th, equity indexes trended steadily upwards, gaining between 4% and 14% except for Chinese markets, which continued to downturn. North American markets benefitted from oversold conditions, a sentiment that the pace of interest rate increases may be slowing, and a report from the Bureau of Economic Analysis showing positive 3rd quarter US Gross Domestic Product (GDP) at the end of the month. BEA News Release

Several economic reports were released that negatively influenced equity prices during the first half of the month:

- Strong U.S. jobs growth and lowering unemployment rate. BLS source CNN CNBC

- Elevated U.S. consumer and producer inflation figures. CPI source PPI source

- Elevated Canadian consumer inflation figures, which decreased slightly but remained high, from 7.0% in August to 6.9% in September on a year-over-year basis. Statscan source

All three fueling speculation that Federal Reserve and Bank of Canada will continue with tight monetary policy.

During the latter half of the month, a market rally was fueled by sentiment that the Federal Reserve and Bank of Canada were getting closer to the end of their rate-hiking cycle, on the back of their strategy to “front load” rate-increases. Ie, raising rates early to reduce the overall negative effects of inflation. Sentiment that interest rates will peak in the first quarter of 2023 gained momentum. Rate slowdown source Slowing rate hikes

Diving into inflation, we are starting to see signs that goods inflation could be slowing down. Shipping costs are decreasing and a current decrease in house purchase transactions is likely to transition into a lagged, but positively correlated effect on retail sales. We have yet to see the price tags widely decrease at the store, but these signs are showing that this is likely to happen. We are still seeing strong inflation in services as well as energy, with an increase in travel and the tight supply of oil and gas, which has continued to be exacerbated by the Russia-Ukraine war. Additionally, the tight US labour market continues to be an issue the Federal Reserve is watching closely, with an eye to prevent a wage inflation spiral. Fed Press Release BEA News Release

What’s ahead for November and beyond?

Interest rates and inflation will continue to affect markets. Going into 2023, the focus will shift from the rate of interest rate increases to how high rates need to go and how long they need to stay there.

The Bank of Canada announces monetary policy on December 7th, January 25th and March 8th 2023, and the Federal Reserve’s FOMC delivered a rate announcement on November 2nd. They announced the expected 75 basis point hike and reiterated their continued intention to “attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.” They also reiterated their stance on reducing their treasury and mortgage-backed security holdings. This caused an immediate market sell-off, as hopes for a confirmation of a pivot on the horizon were squashed. Fed Press Release

The Federal Reserve’s next meeting will be on December 14th, followed by February 1st and March 22nd 2023. There will be speculation prior to each of these announcements, and both the speculation and the monetary policy shifts will move markets. Although we continue to get a sobering stance from the Federal Reserve, this doesn’t nullify the idea that rates could peak in the first quarter of 2023. The Bank of Canada and Federal Reserve will each have three opportunities to raise rates before the first quarter of next year ends.

A pivot will be more probable if we experience deeper economic setbacks, which is looking more likely. Recession indicators are flashing, which include inverted 10/2-year and 10-year/3-months yield curves, declines in global PMIs, heightened geo-political risks from Russia and China, and signs of peaking profit margins. There is a distinct possibility that the Federal Reserve and Bank of Canada have an economic pain threshold, which if reached will cause them to pivot, even if inflation is not back to the 2% target.

A proven long-term defense during periods of uncertainty is to select investments that match an overall strategy and monitor them to adjust accordingly, as we are doing with our model portfolios. Beware traps such as utilizing unreliable or inexperienced sources, moving outside your risk tolerance, or jumping into investments you do not understand, as these can quickly undermine the discipline that has been built to preserve your retirement savings. Please reach out to us if you’d like a review of your investments.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments