Last Month in the Markets – November 1st – 30th, 2022

What happened in November?

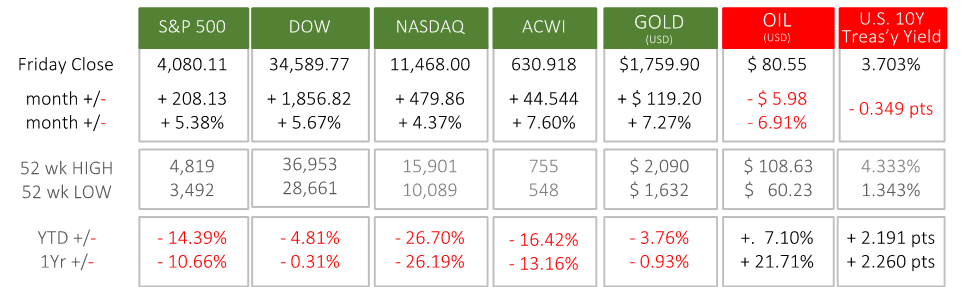

Overall, the markets were largely positive last month. The major American equity indexes rose 4.4 to 5.7%, and the global All Country World Index (ACWI) jumped 7.6%. Notably, the price of oil fell and gold’s safe haven attributes shined, with a 7.27% gain. Although bond yields were down slightly for the month, they have doubled in 2022.

Three notable events were the primary triggers for November market moves:

1 . November 2nd – Federal Reserve interest rate decision

The focus of speculation was not whether an increase would occur, but the size of it and the implications for future increases. Chair, Jerome Powell, announced a .75% interest rate increase. Federal Reserve release CNBC article

2. November 10th – U.S. Consumer Price Index released

Price increases were below expectations at 0.4% for October and 7.7% on a year-over-year basis. The monthly increase repeated September’s level while annual inflation fell to its lowest level since January, and 1.5% below June’s recent peak.

On the day of the release, North American equity indexes posting their best trading day since 2020. The consensus belief is that the Federal Reserve’s interest rate hikes have begun to slow inflation and that smaller interest rate increases will be required in the future. BLS CPI release CNBC CPI analysis CNN rate/CPI reporting

3. November 30th – Speech from Federal Reserve Chair, Jerome Powell

The dovish indications from Chair Powell caused U.S. indexes to jump 3-4% on the last day of the month. The TSX followed by moving up nearly 1%. Transcript of Powell Speech NYTimes analysis

We continue to see relief in energy prices and goods inflation, stemming from the resolution of supply chain bottlenecks. Even though the December 2nd Canadian and U.S. jobs data for November came in above expectations, the labour market overall is starting to show hints of cooling, as wage growth has been on a downward trend since September. This continues to be a huge focal point for the Federal Reserve. Atlanta Fed Wage Growth Tracker

Other factors continuing to have a notable influence over North American markets include China and the Russia-Ukraine conflict. There has been a Covid resurgence in China and a subsequent re-lock down. This continues to hurt imports, exports, and general economic growth. We have seen protests to the lock down, but they are unlikely to change government Covid policies any time soon. Low vaccination rates and immunity levels among the population would pose danger if China suddenly re-opened. The geopolitical issue of Russia’s war against Ukraine remains unresolved.

What’s ahead for December and beyond?

The Federal Reserve’s next opportunity to raise interest rates will occur on December 14th, which is one week after the Bank of Canada’s next scheduled announcement. Markets are expecting a reduced rate hike of .50%. Forbes

The pandemic and economic recovery that initiated much of the jobs growth in the first half of 2022 will continue to influence economic conditions. Powell indicated in his last speech that a lag occurs before central bank policy takes effect and “it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down”. Many indicators such as easing supply chains and weaker demand for goods are beginning to suggest the time for moderating is approaching. If central banks do moderate, the pause allows them to assess the impact of their policy. As services and cost of shelter are likely to remain elevated, the hope is that the continued reduction in prices of goods can bring the aggregate number down enough to justify the pause. If this fails to materialize, their as risk of a return to tightening and the volatile markets of 2022.

Additionally, recessionary pressures remain. As we have been experiencing over the last few months, investors are eager to return to a positive market sentiment. The recent remarks from the Federal Reserve have potential to sustain the market rally going into year end. This, however, doesn’t mean we are out of the woods. The full effect of recessionary pressures has not yet been felt in the economy or accounted for in earnings projections. As these are seen in 2023, it could reverse the current momentum. Economic indicators are still pointing to an upcoming recession, such as the conference Board’s The Conference Board Leading Economic Index. The Conference Board Leading Economic Index

In summary, we are seeing steps in the right direction but haven’t reached the end yet. It remains important to continue to exercise patience and stick to your overall investment strategy. If you would like a review of your investments, we are here to help.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments