Last Month in the Markets – May 1st – 31st, 2023

What happened in May?

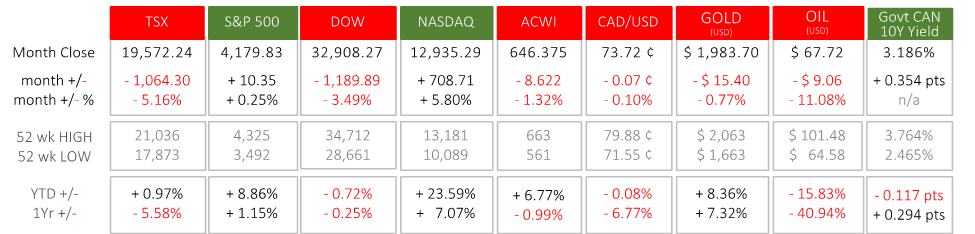

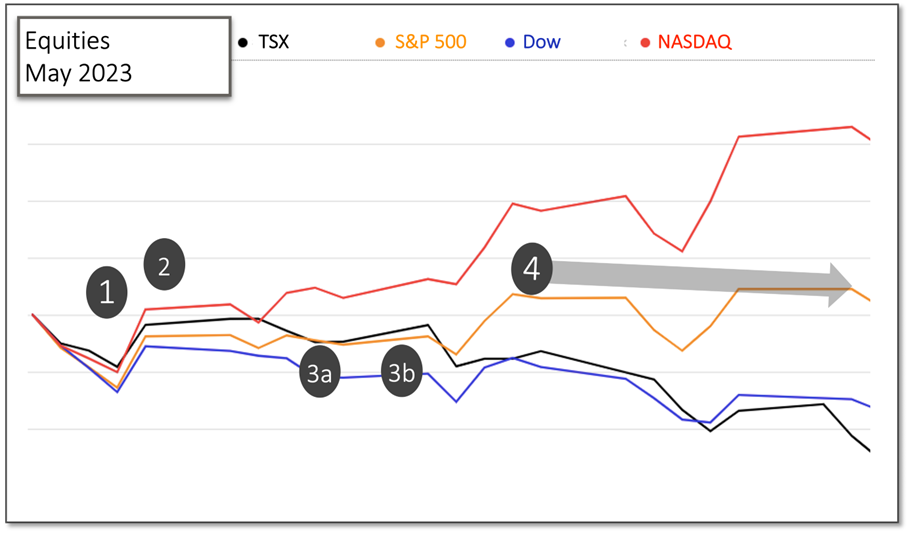

Last month saw divergence among major North American equity indexes. The NASDAQ gained more than Canada’s TSX lost, plus 6% against minus 5%. The S&P 500 and the Dow delivered performance with a gap of nearly 4%, plus .25% versus minus 3.5%, respectively. The markets were weighted down by negative factors over the course of the month, such as a shift in investor expectations to a more hawkish path of the US interest rates and the risk of a negative economic shock from the U.S. debt ceiling situation. This was counterbalanced by positive momentum for a basket of technology stocks concentrated in the NASDAQ, based on the potential for Artificial Intelligence (A.I.) to give a boost to company profits.

May concluded with the passage of the debt ceiling bill in the U.S. House of Representatives showing a step forward in keeping the US government operating and allow the U.S. Treasury to meet its obligations. Several other influential events occurred:

- May 3rd – U.S. Federal Reserve increased its federal funds rate by .25%. The meeting minutes of the Federal Open Market Committee indicated that the decision was not unanimous. Equities dipped temporarily on recession fears. https://www.federalreserve.gov/monetarypolicy/fomcpresconf20230503.htm

- May 5th – Equities recovered quickly from the Fed’s rate increase when Canadian and U.S. jobs data was released. Employment rose by 41,000 and 253,000 in April respectively, and unemployment remained unchanged in both countries at 5.0% and 3.4%. The strength of the jobs market showed that a recession was not immediately on the horizon. https://www150.statcan.gc.ca/n1/daily-quotidien/230505/dq230505a-eng.htm?HPA=1&indid=3587-2&indgeo=0 https://www.bls.gov/news.release/empsit.nr0.htm

- May 10th – April’s inflation report was released showing it had not responded to interest rate increases as much as needed but had not gotten too much worse either. As a result, markets held steady.

- U.S. consumer inflation rose 0.4% in April and 4.9% on a year-over-year basis. Shelter was the largest contributor to the monthly increase, followed by vehicle and gasoline prices. https://www.bls.gov/news.release/cpi.nr0.htm

- May 16th – Canadian inflation rose more in April at 0.7% for the month and 4.4% for the year. https://www150.statcan.gc.ca/n1/daily-quotidien/230505/dq230505a-eng.htm?HPA=1&indid=3587-2&indgeo=0

- U.S. debt ceiling negotiations continued throughout the month and became increasingly concerning for markets during the second half, as the deadline to avert a crisis approached. Over the last weekend of May, a deal was agreed by Biden and McCarthy. Over the next three days the legislation, entitled The Fiscal Responsibility Act, was debated, and passed in the House. It then fast-tracked through the Senate, which passed it at the beginning of June. https://www.cnbc.com/2023/06/01/debt-ceiling-bill-updates.html

As the US market seemed to show resilience in May, it is important to note that gains were primary concentrated in a few companies, while the broad-based market, including small caps underperformed. This dynamic is also seen in the year-to-date results, which show that without the high weightings of Apple, Microsoft, Google, Amazon, Nvidia, Tesla, and Meta in S&P 500 index, it would be tracking a negative return so far this year. While the prospects of AI look promising in the long term, the level of optimism priced into the valuations of these companies, especially against the divergence of continuing contractionary monetary policy and the rest of the market, is something to remain cautious about.

Internationally, a poor global manufacturing backdrop has given data showing that China’s post-lockdown recovery is slowing. In Europe, the tighter monetary policy narrative saw another interest rate increase of .25% in May by the European Central Bank. The Region performed poorly last month stemming from the uncertain global economic backdrop and the continued rate hikes. However, low valuations in Europe are providing a stronger base for asset price bottoms. CNBC CNBC

What’s ahead for June and beyond in 2023?

Now that the U.S. debt ceiling crisis has been avoided, markets will return to their usual priorities, inflation, interest rates, economic growth, and the linkages between them. AI hype might continue but as valuations are currently stretched because of it, continued momentum will hinge on a high barrier of continued good company reporting.

Inflation has stopped growing but it is remaining much higher than the 2% annual rate targeted by Canadian and American central banks. A big part of inflation stickiness has come from the heated labour market, which as shown recent signs of softening. The US May employment report showed an increase in the unemployment rate by .3%, bringing it to a 7th month high of 3.7%. Although this trend is not defined enough to draw any long-term conclusions, it will help the case for a rate pause at the next Federal Reserve meeting. Employment Report

Ultimately, the recessionary pressure is starting to work its way into the economy and will progress, especially if interest rate increases continue. We will gain further insight to the North American central bank positioning in the middle of June, when the next two opportunities to adjust interest rates will arise, June 7th in Canada and June 14th in the U.S.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments