Last Month in the Markets – May 2nd – 31st, 2022

What happened in May?

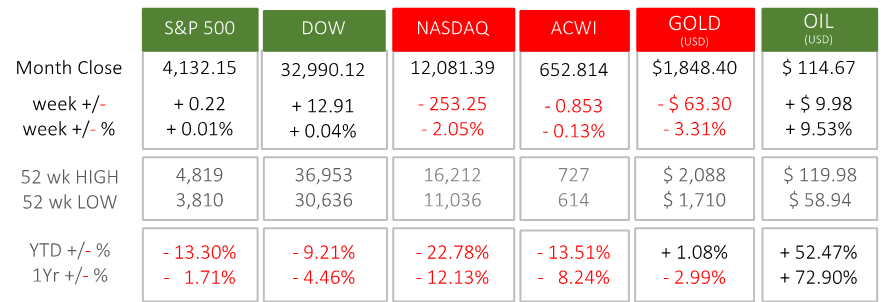

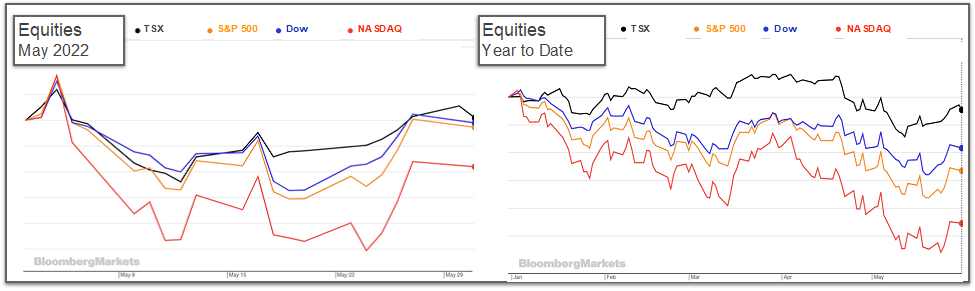

We saw continued volatility through May, with a sharp drop lasting until the 3rd week, with the S&P touching bear market territory (which is defined as a decline of 20% from price peak) on May 20th , finishing with a sharp rebound. The NASDAQ, more heavily weighted to technology, ended the month with a loss of 2%. The broad-based TSX and S&P 500, and the large corporates of the Dow, ended flat.

The price action began on Wednesday, May 4th, when the U.S. Federal Reserve increased short term interest rates. The 0.50% increase to the federal funds rate was the largest increase since 2000. Immediately after the Fed’s announcement, equity markets reacted positively, with a small sigh of relief the rate hike wasn’t higher, speculation was 0.75% increase. However, the rally was short lived, and the next day began May’s biggest drop. Fed Press

The Energy sector continued to outperform as crude oil rebounded from it’s pull back during March and April. Fueled by continued supply and demand imbalances, with the continuing progress of the European Union Embargo and easing mobility restrictions in the United States and Europe.

The major theme in the markets continue to be the issue of inflation and the reaction of Central Banks. We have not seen inflation numbers this high since the early 1980s, and the tedious balancing act of the central banks trying to ease inflation without pushing their economies into recession continues to play out. Therefore, inflation numbers have a big impact on asset prices currently.

The release of the U.S. Consumer Price Index (CPI) on May 11th was a significant contributor to equity volatility and losses during the second week of the month. The release stated an April inflation increase of 8.3% over the past year, down from the March year over year number of 8.5%. This was led by fuel, shelter, food, airline fares and new vehicles. Ongoing inflation at this high-rate signals that the Federal Reserve will remain aggressive on monetary policy, especially for short-term interest rates. U.S. Bureau of Labor Statistics

We are all waiting to see when inflation will peak. The good news is that US inflation growth in April was less than March, whereas up until now from the start of the year, we have been seeing a steady increase of around .5% month over month. U.S. Bureau of Labor Statistics

We have also seen a small contraction in US year over year quarterly GDP data of 1.5%, which on the face of it may seem negative, but slowing economic growth is a strong catalyst for inflation growth to subside. Bureau of Economic Analysis

The US economy also showed base signs of strength. April’s non-farm payrolls released on May 6th showed that employment had increased by 428,000. The unemployment rate was released as 3.6% and number of employed (5.9 million) holding steady, which is back to pre-pandemic levels as indicated by the Bureau of Labor Statistics referencing the similar data in February 2020. The labor force participation rate is 1.2% below the February 2020 level of 63.4%. bls.gov

In Canada, we also showed strong employment numbers, with the unemployment rate falling to a record low. Average hourly wages rose at an annualized rate of 3.3%, unchanged from March. StatsCan

The inflation numbers in Canada’s Consumer Price Index (CPI), weren’t as positive as in the US but still showed signs of slowing, moving up slightly to 6.8% vs March’s 6.7%, driven by food and shelter. Compare this to a full 1% increase from February to March. StatsCan link

On the global front, the Ukraine Russia war is continuing, putting pressure on food and crude oil prices, as well as creating a large recession risk in Europe.

We are seeing encouraging signs from China. After 4 straight days of no COVID cases, Shanghai eased restrictions on June 1st. The situation remains sensitive, the authorities have since initiated mass COVID testing following an outbreak at a bar. Chinese COVID cases are still comparatively extremely low, but authorities are maintaining a zero-COVID policy. If China can stay out of lockdown, we should see a boost to economic growth that will help the global economy. This won’t be instantaneous however; it may take around a half a year to see effects. Reuters

What’s ahead for June and beyond?

These themes will continue until headwinds start to resolve, with continued high price of commodities and market volatility.

On June 1st, the Bank of Canada increased short-term interest rates by the same .50% that was incurred in April. The Fed has signaled a similar action in the coming weeks. Their next interest rate meeting is on June 15th and they have telegraphed a .5% increase, which is also expected for the meeting on July 27th. The US inflation numbers for May were announced on June 10th, which came in at 8.6%, showing an increase from April. A big part of this was the momentum of the price of crude oil in May that should ease in June. However, this will most likely keep the Federal Reserve aggressive in their actions through the next two meetings.

The effects of higher interest rates in Canada and in the U.S. will be further felt in the coming months. As inflation expectations are being priced in and Central Bank policies begin to take a deeper effect, slowing economic growth will continue to be an offshoot. We have yet to see a downwards revision on GDP and earnings expectations, this is a theme that is likely to emerge, it will need to be closely watched. With North American economic base remaining strong however, the reaction should be short lived.

Bottom Line

We continue to wait patiently. Once inflation peaks and earnings revisions are captured, markets should begin to stabilize. In the meantime, our defensive portfolio stance continues, we are overweighting defensive sectors and countries such as Canada, while minimizing exposure to Europe and emerging markets. We are targeting holdings that provide sustainable dividends and buffers against the current macro economic challenges, such as financials and infrastructure. This provides our model portfolios with better price stability and income while we wait out the current environment. On the fixed income front, we continue our exposure to floating rate notes. The negative sentiment we are experiencing should soon set valuations to prime for a renewed upward direction once headwinds clear.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments