Last Month in the Markets: March 1st – 31st, 2023

What happened in March?

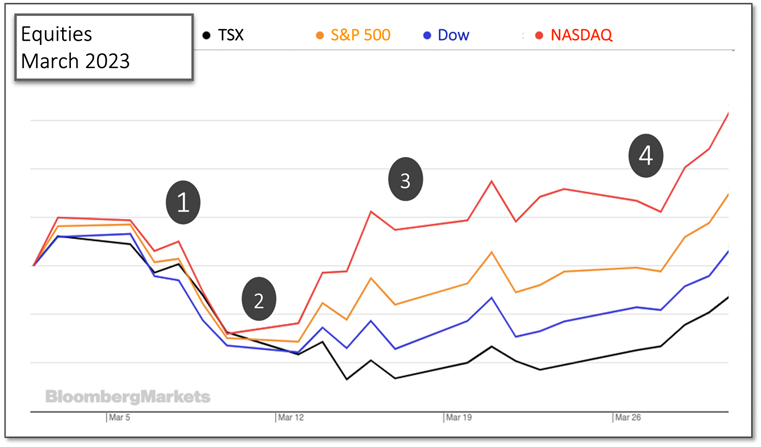

March was a chaotic month for investors, especially those with holdings in financial services. Interest rates, inflation, and the job market continued their influential roles, but to add another element to an already tricky situation, the failure of two U.S. banks and a government-led acquisition of Credit Suisse by UBS caused concerns over financial system stability. We had a choppy month; with an initial rally, swift drop, and then a rebound.

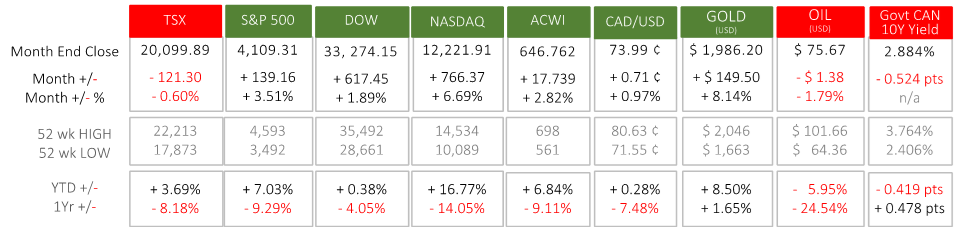

Despite the volatility, the major indexes mostly posted monthly gains, with exception to the TSX, which lagged due to its large exposure to the financial sector. The major US indexes had a respectable month for returns but they varied widely across sectors. Financials and Small Caps (marked by the Russell 2000, which ended the month down 4.8%) being the worst performers and Communication Services and Information Technology being the best, followed by Consumer Staples and Utilities. North American government and high-quality corporate bonds had a great month, as the banking crises caused bond yields to decline. High yield bonds, though still ending in positive territory, under performed as credit spreads widened.

Oil, along with industrial metals, had a further price decline due to contagion fears. Gold posted a sizable gain of 8.2%, acting as the flight to safety from the financial system and working off tailwinds from declines in the US dollar and real estate. The US dollar declined due to the banking crisis causing the market to expect a slow down in rate increases from the Federal Reserve.

Highlighting the major turning points:

1. On March 7th, Federal Reserve Chair, Jerome Powell, testified in Washington where he reiterated the central bank’s commitment to reduce inflation to the target of 2%. As the US economy had been showing strength, he reiterated the stance that interest rates are likely to be higher than anticipated, leading to an equity market sell off. Watch Powell video

2. Most of the attention has been paid to the effect on consumers from rising interest rates, but financial institutions were exposed, too. As short-term rates rose, banks were forced to pay current rates on deposits, while their long-term investments began to take losses, as they were locked into lower interest rates. This caused a decrease in their asset base and a narrowing of their margins. A confidence-crisis bank-run resulted, causing regulators in California to shut down Silicon Valley Bank on March 10th. This led to additional scrutiny and wider worries for bank solvency and was amplified when the FDIC closed Signature Bank on March 12th. This triggered a further decline in equity indexes. SVB Fallout Spreads

3. Equity markets began a tentative recovery after the U.S. Treasury Department, Federal Reserve and Federal Deposit Insurance Corporation added increased protections for depositors and introduced a new borrowing facility to allow banks to meet short-term cash needs. Joint release

The effects of increasing interest rates were not limited to the United States. The recovery was imperilled when Credit Suisse went into insolvency and was rescued by UBS under very generous conditions. The deal was brokered by the Swiss government to protect depositors, some investors, and the Swiss banking reputation. Since then, Switzerland’s Attorney General has launched a criminal investigation into the takeover, causing more risk to a lowering of confidence in the banking sector. Swiss investigation CS/UBS

4. As the failures, takeovers, and concerns for banks continued so did the analysis and reflection. The growing sentiment became that many of the most at-risk banks had general problems with managing their assets and were heavily exposed to interest-rate-risk. This was compounded by a strong downward pressure on bank deposits due to the increasing competition from attractive money market yields. As government institutions stepped-in to protect depositors and reassure investors, the markets responded favourably. CNBC and bank contagion

What’s ahead for April and beyond in 2023?

As Jerome Powell stated during his press conference following the interest rate decision on March 22nd, it is expected that lenders will raise requirements, which will limit access to capital. This will allow banks to hold cash for liquidity and potentially increase income going forward through lending at higher rates. Evening though the Federal Reserve’s rescue for the depositors of the two failing banking increased their balance sheet considerably, they are still continuing with their tightening program overall. These occurrences have changed market sentiment to expect the Federal Reserve will ease off interest rate increases faster than originally thought due to concern over financial system stability and tightening in lending standards putting a further choke hold on the economy. While this has caused a continued rebound in speculative stocks, North America is still at a high probability that recession will need to occur before rate cuts, making the overall narrative unchanged and the rally on a shaky footing.

Central banks will continue to monitor overall economic growth (Gross Domestic Product), employment, as well as inflation. Inflation growth has begun to slightly decline but still remains far from the shared target of 2%. The next scheduled interest rate decisions from the Bank of Canada, Federal Reserve and European Central Bank are April 12, May 3, and May 4, respectively.

BoC monetary policy Fed monetary policy ECB monetary policy

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments