Last Month in the Markets – July 3rd – 31st, 2023

What happened in July?

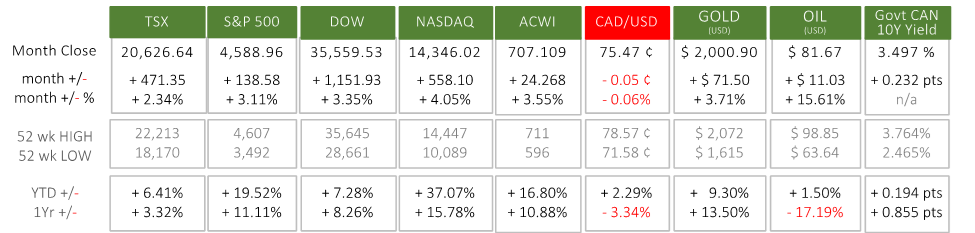

North American equity indexes added another 2 to 4 percent to their year-to-date advances on positive news on the inflation, jobs, and monetary policy fronts. Gold, oil, and Canadian government bonds also increased as the Canadian dollar nearly broke-even after losing just five one-hundredths of a cent by month’s end.

Like last month, July ended strongly. June achieved an exceptional day of gains for equity indexes on the 30th, while July earned its positive returns over the last two-thirds of the month.

July 5th – The month began slowly with markets closed for the official observance on July 3rd of Canada Day and Independence Day on July 4th. Following the two holidays the Federal Reserve released the meeting minutes from its previous Federal Open Market Committee that included interest rate deliberations and opinions of its committee members. The belief that the federal funds rate must be raised to 5.6% (up from their March 2023 projection of 5.1%), and their unanimous decision to raise rates at their mid-June meeting, sent equity markets lower. FOMC Meeting Minutes Summary of Econ Projections

July 7th – Continued strength in employment for June held markets steady. The increase of 60,000 and 209,000 additional jobs in Canada and the U.S., respectively, represented a situation where “good news” might actually be “bad news”. A robust labour market that is able to fuel consumer demand and inflation might require more severe monetary policy from the Bank of Canada and the Federal Reserve. Markets were wary, and held their ground, and did not rise on this news that might otherwise be interpreted positively. StatsCan June Jobs BLS U.S. June Jobs

July 12th – The U.S. Bureau of Labor Statistics reported that the Consumer Price Index had risen 0.2% in June, and the all-items index had risen 3.0% over the last 12 months. Shelter continued as the largest contributor to price increases, along with groceries and food away from home. Energy prices fell, especially gasoline, heating oil and natural gas, while electricity prices rose.

The Bank of Canada increased its benchmark interest rate by ¼ percent (25 basis points to 5%. The small increase was aligned with expectations and was driven by easing inflation and lower energy prices and a decline in goods price inflation. “However, robust demand and tight labour markets are causing persistent inflationary pressures in services” according to the Bank’s press release and in its Monetary Policy Report.

The lowering inflation and tempered policy by the Bank of Canada were viewed positively and markets turned upward in response.

July 18th – Actual good news was announced by StatsCan as consumer inflation rose on a year-over-year basis by 2.8%, which was down from the previous month’s annual inflation of 3.4%. The devil-is-in-the-details since much of the decline could be attributed to falling gasoline prices in June. “Excluding gasoline, headline inflation would have been 4.0% in June, following a 4.4% increase in May. Canadians continued to see elevated grocery prices (+9.1%) and mortgage interest costs (+30.1%)” based on StatsCan analysis. StatsCan CPI Release

July 26th – The Federal Reserve increased its interest rates, again by 25 basis points (¼ percent). There may have been some hope that a pause in rate increases might be permitted by slowing inflation, but once the news was received it was digested well, and markets rose again. Fed Press Conf

July 28th – The Fed’s primary inflation indicator, the Personal Consumption Expenditures price index showed an increase of 3.0% over the past year and 0.2% for June, which is a very positive indicator. PCE Release

What’s ahead for August and beyond in 2023?

The continuous flow of news of the battle against inflation and interest rates is wearying. Although, the conditions persist to ensure that monetary policy will be closely followed, the next Bank of Canada and Federal Reserve announcements will occur on September 7th and 20th, respectively. A brief reprieve from the bombardment of speculation and news from central banks could be quiet to markets and the balance of summer.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments