Last Month in the Markets – July 1st – 29th, 2022

What happened in July?

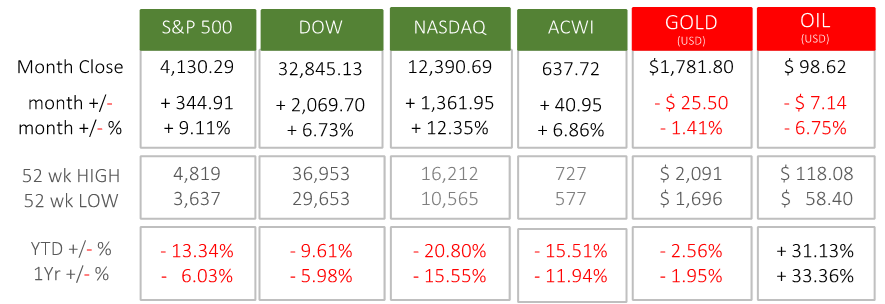

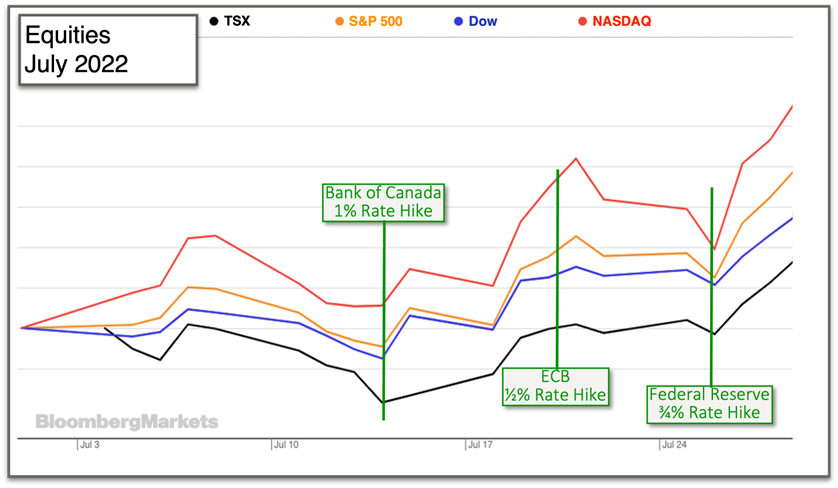

The first half of July saw a hold to the June bottom for major American indices and a bullish turn around for North American indices in the second half of the month. This was marked by the Beige Book release by the Federal Reserve and the release of interest rates and commentary by the Bank of Canada on July 13th. This rally continued in the last week of the month when the Federal Reserve gave their expected interest rate increase and commentary.

Inflation and Central Bank actions continue to be a big influence on capital markets. The European Central Bank (ECB), the Bank of Canada and the Federal Reserve all raised their benchmark interest rates in July, moving their rates .5%, 1% and.75% higher, respectively. Although each deployed increases of varied amounts, their objective was identical. Inflation is running far outside the target range in each country and increasing the cost of borrowing is the primary method to slow economic growth by slowing demand, which will slow inflation. ECB Statement Boc Release Fed Announcement

The market rally was from a few things: oversold conditions, Central Banks acknowledging their “front loading” of interest rate increases, the Federal Reserve acknowledging the weakening economic conditions, and market expectations that Inflation is beginning to peak as economic growth slows; in turn causing Central Banks to be less aggressive. These factors put pressure on global bond yields, causing bond prices to rally, which in turn brought the discount rate for stocks down, fueling a broad-based rally and an outperformance in high-duration, tech heavy indexes like the Nasdaq.

“Front loading” interest rate increases is a tactic where larger increases are being made earlier to give the ability to taper the size of future increases. The promise of smaller future increases suggests that avoiding recession (or minimizing it) is becoming more of a concern for Central Banks, as making the bulk of the increases come earlier could lead to a shorter term for the resulting economic slowdown.

Even though expectations are shifting, we have yet to see official reports of inflation slowing. The latest inflation report numbers for June came out showing U.S. consumer inflation reached 9.1% and 8.1% in Canada on an annualized basis. And the latest monthly report in the US showed a 1.3% increase in inflation versus 1% one month earlier. U.S. Bureau of Labor Statistics StatsCan

However, a big factor with inflation has continued to be Energy, which showed signs of relief in July. Commodity prices have slowed their growth and, in some cases, reached lower levels. Driven by worries of an economic slowdown, oil was trading near $90 during July from recent highs near $120 per barrel. Since transportation costs based on fuel prices affect the prices of almost every other good or service, this brings welcome anti-inflationary news.

The cost of oil has been heavily influenced by geopolitical matters since the invasion of Ukraine. Although no diplomatic solution has been reached and Eurozone energy supplies remain at risk, it appears that Europe’s ability to curtail demand could also be contributing to lower energy prices. This, plus the positive market response to Central Bank actions over course of July is brings much needed signs that North American and European markets are finding at least a temporary footing.

China did not fair as well during the month. The Shanghai and Hang Sang indices generated negative returns through July, breaking their positive momentum through June and May. This was due to a disappointing growth outlook for the second half of the year, brought on by the slumping property market, rotation of global demand away from goods and into services, and their zero Covid policy.

What’s ahead for August and beyond?

We remain optimistic but cautious. Central bank actions and inflation will continue to be the narrative. Despite the major rebound at the end of July, it will take more lasting momentum to create a resilient rebound for equities. The positive signs of a peak in inflation will not be enough to cause Central Banks to reverse their policies entirely.

For example, in the US the target rate of inflation is centered around 2%, and the Federal Reserve expects inflation to stay above 4% going into the end of the year, only getting close to their target in 2024. Time will need to pass to allow current and future interest rate increases to take effect, so even though some anticipate rate cuts in 2023, Central Banks could well be either only pausing or still raising rates. In the FOMC’s latest summary of Economic Projections, the Fed shows that they expect a target federal funds rate to be in the range of 3.5% – 4.5%, given that the current rate is 2.25% – 2.50%, we still have some climbing to do. FOMC Summary of Economic Projections

On the recession front, recent earnings have not been as bad as many have feared. We have also seen some effects of the tighter monetary policy through lower GDP releases in the last two quarters but the continuation of it and as economic indicators confirm, such as continued inversion of the yield curve, we haven’t seen the full effects yet.

The Bottom Line

We continue to like floating rate instruments for fixed income exposure and defensive stocks but are also slowly weighting into high quality growth stocks. Companies with a good financial bases will remain resilient, and as growth continues to be elusive, the companies who exhibit stable growth will be well rewarded. Other than that, it is important to keep focused on your long-term goals and make sure your financial plan reflects them. If you’d like to get a better sense of where you are at or have any questions, please reach out to the Qopia team.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments