The financial services industry is evolving faster than ever. In 2025, artificial intelligence (AI), robo-advisors, and algorithmic platforms are now deeply woven into how portfolios are built and rebalanced. These tools offer impressive capabilities — instant access, low fees, and precision analytics — and they’ve certainly carved out a role in modern investing.

But despite their rise, one truth remains clear for high-net-worth (HNW) investors: technology alone isn’t enough.

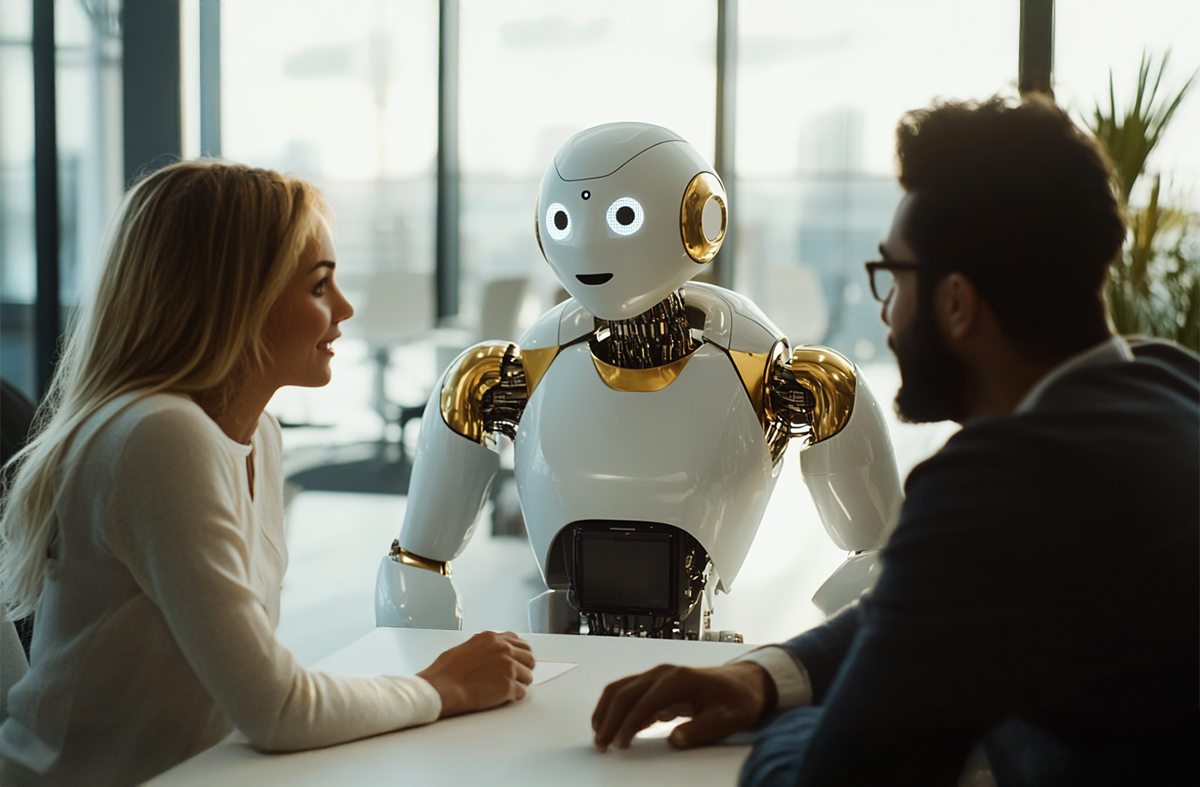

At Qopia Financial, we embrace innovation but remain rooted in the belief that successful wealth management depends on human relationships. Our clients aren’t just looking for automation; they want a financial strategy, continuity, and a trusted advisor who understands their full financial picture. Here’s why the human element still matters — and always will.

Beyond Binary: The Art of Strategic Financial Thinking

AI excels at analyzing data and identifying patterns based on historical information. What it cannot do is understand the nuanced aspects of your life journey and personal values that inform truly strategic financial decisions.

When markets behave unpredictably or your life circumstances change dramatically, algorithmic responses follow pre-programmed paths. Human advisors, however, can think laterally, drawing on years of experience and emotional intelligence to craft bespoke strategies that consider factors no algorithm could weigh:

- The complex family dynamics affecting your succession planning

- Your evolving relationship with risk as you progress through different life stages

- The emotional significance of certain investments or assets beyond their monetary value

- The subtle interplay between your philanthropic goals and tax strategy

These considerations require contextual understanding and creative problem-solving that remain firmly in the human domain.

Relationship Continuity: The Value of Being Known

The most significant limitation of AI-powered financial solutions is their inability to know you as an individual. A good advisor builds relationships spanning decades, sometimes generations. This continuity creates a depth of understanding that algorithms simply cannot replicate.

Your human advisor remembers the conversation when you mentioned your lofty dreams and aspirations. They notice when your risk tolerance shifts after a major life event. They understand your unique dynamics with your business partners or family members.

This institutional memory and relationship intelligence allow human advisors to anticipate needs before they’re explicitly stated and to provide counsel that respects your complete financial and personal history.

Integrated Planning: Seeing the Full Picture

While robo-advisors have become increasingly sophisticated at portfolio management, they remain fundamentally limited in their ability to integrate all aspects of wealth planning:

- Tax optimization across multiple jurisdictions

- Business succession planning with complex stakeholder considerations

- Estate planning that balances financial efficiency with family harmony

- Philanthropic strategies aligned with personal values and legacy goals

These interconnected elements require a holistic view and the ability to navigate ambiguity, qualities that remain distinctly human. Our advisors excel at seeing how each decision ripples across your entire financial ecosystem, something algorithms still struggle to comprehend.

The Human Element in Times of Turbulence

Human advisors provide something no algorithm can: true empathy and steady guidance during market volatility or personal crisis.

When markets plummeted during the economic challenges in 2020, our clients didn’t want to interact with an app or algorithm. They wanted to speak with someone who understood their concerns, could contextualize the situation based on historical perspective, and provide reassurance grounded in personal knowledge of their financial situation.

The psychological aspects of wealth management—managing anxiety, maintaining discipline during market fluctuations, balancing competing family priorities—require human connection and understanding.

Our Approach: Technology-Enhanced, Human-Centered

At Qopia Financial, we don’t see the choice as binary between robo-advisors and human advisors. Instead, we’ve developed a model that leverages the best of both worlds:

- Committee of Portfolio Managers that continuously review and test our portfolios

- Advanced analytics and AI-powered tools that enhance our human advisors’ capabilities

- Digital platforms that provide transparency and on-demand information

- Streamlined processes that eliminate administrative friction

- Human judgment, creativity, and relationship-building where it matters most

- Consideration of the right mix of private and public asset classes to balance your portfolio

This hybrid approach allows us to deliver efficiency and data-driven insights into technology while preserving strategic thinking, relationship continuity, and integrated planning that only human advisors can provide.

Looking Forward: The Future is Human+AI, Not AI Alone

As we look to the future of wealth management, the most successful approach will neither reject technological advancement nor surrender to full automation. Rather, it will thoughtfully integrate AI capabilities to enhance what human advisors do best.

At Qopia Financial, we’re committed to remaining at the forefront of financial technology while ensuring that human relationships remain central to our service model. Because while algorithms can calculate optimal portfolios, only people can truly understand what wealth means to you and your family.

In a world increasingly driven by automation, we believe the human difference isn’t just valuable—it’s essential. Contact us today to meet with one of our team members and start building a human relationship.