Last Month in the Markets – August 1st – 31st, 2023

What happened in August?

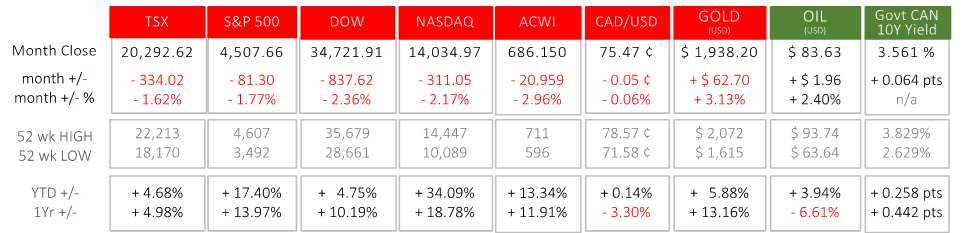

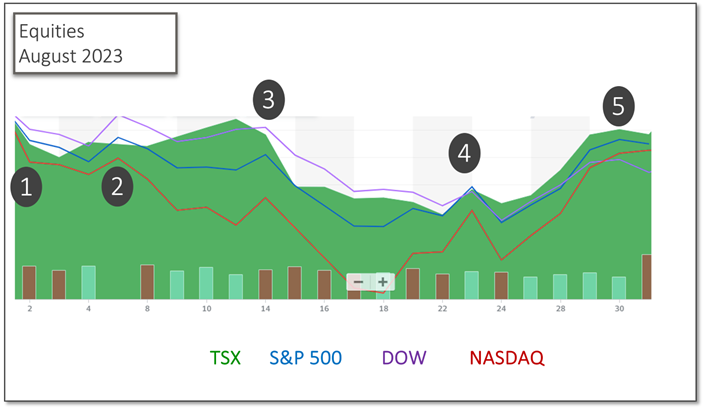

In tandem with global financial markets, North American equity indexes relapsed in August, losing about 2%, and trimming year-to-date performance for the TSX and Dow to less than 5%. The Dow’s 1-year returns at 10% has more than doubled TSX, which sits below 5%. The S&P 500 and NASDAQ have done well at 17% and 34%, respectively, in 2023, and 14% and 19% year-over-year. This month, investors redirected their attention towards the possibility of a “no-landing” scenario, where robust overall demand maintains inflation levels above target, compelling Central Banks to implement additional tightening measures. This fuels the environment for a delayed and possibly worse economic downturn.

China, being the world’s second largest economy with significant international trade, also weighted down global performance during the month, with local equities took the heaviest of the losses. The disappointing re-opening of the Chinese economy has led to anemic growth, which has recently caused investors to put faith in government stimulus measures. The lack of current meaningful stimulus, marking by only a few basis points of bank rate cuts and a reduction in stock market transaction levies, dampened market confidence.

The fixed income markets showed a sharp rise in government bond yields in the first half of the month, after which they reversed, as prices rose, but still ended in the red. Given that monetary policy is already considered restrictive in the Euro Zone and North America, there is limited room for additional tightening and it’s probable that both US and Euro Area government bonds have reached their cycle peaks.

For Commodities, the continued relative resilience of the US economy is keeping the dollar strong, crude oil rallied due to tightening supplies. On the negative side, China’s economic weakness put downward pressure on industrial metals, and gold continues to underperform due to high interest rates causing a large cost of carry and the strength of the US dollar.

Breaking down the month, August ended strongly, with a final week that delivered gains of 1.5% to 3.5% for the major North American indexes. However, this wasn’t enough to recover from negative performance in the third week.

August 1st

Fitch Ratings downgraded the quality of U.S. sovereign debt from “AAA” to “AA+” reflecting “the expected fiscal deterioration over the next three years, a high and growing general government (GG) debt burden, and the erosion of governance relative to . . . peers . . . that has manifested in repeated debt limit standoffs and last-minute resolutions.” The government debt issue is driven by weaker federal government revenue, new spending initiatives and higher interest rates as the general government deficit is predicted to rise to 6.9% of Gross Domestic Product in 2025. The debt-to-GDP ratio is forecasted to rise to 118.4% by 2025. CBC and FitchPress Release from Fitch

August 4th

U.S. Employment situation summary and the Canadian Labour Force Survey were both released. Markets treated this data with wariness since the American job market continued its resiliency concern that interest rates would remain at current levels grew. In the U.S., non-farm payroll employment rose by 187,000 jobs in July, and the unemployment rate was unchanged at 3.5% as 5.8 million Americans are unemployed. Employment in Canada was static in July with 6,000 less jobs, which represents a change of less than one-tenth of a percent. The unemployment rate rose 0.1% to 5.5%, the third consecutive monthly increase. StatsCan July Jobs BLS July Jobs NYTimes Jobs

August 14th and 16th

Economic indicators from China began to turn downward showing China’s economic recovery and growth are slowing. The economic integration by Canada and the U.S. differs in magnitude and by overall trade balance, and “bad news from China” has affected different stocks and sectors differently in North America. Canada’s closer ties caused a steeper decline than American indexes, but overall, both sides of the border were impacted. China Trading Partners China’s economic woes

The Federal Reserve also released its meeting minutes on the 16th from the July interest rate decision. The participants noted that “recent indicators suggest the economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.” The committee voted unanimously to keep rates steady, while “prepared to adjust the stance of monetary policy as appropriate.” Fed Minutes

August 25th

On August 25th, Fed Chair, Jerome Powell, spoke about “Inflation and the Path Forward.” According to Powell, inflation is still running too high. He noted that over the past year, “restrictive monetary policy has tightened financial conditions, supporting the expectation of below-trend growth.” In reaction to these comments, equity markets moved higher on the last day of the week, especially the Dow. Read Powell’s speech Watch Powell’s speech CNBC summary

August 31st

The month concluded on a high-note when Atlanta Federal Reserve Bank President Raphael Bostic indicated that “policy is appropriately restrictive” during a speech in Cape Town, South Africa. Although he did not indicate that it was time to ease monetary policy, he stated patience is needed to allow the current restrictive policy to influence the economy and not inflict unnecessary economic pain.” The Fed is expected to leave rates unchanged at its next meeting. CNBC and Bostic

What’s ahead for September and beyond in 2023?

The Bank of Canada decided to keep its overnight rate steady at 5% at it’s announcement on September 6th. The deliberations showed concern that the possibility of raising rates too quickly and too far is important for members of the rate-setting committee, but that it still focused on keeping inflation pressures down. The next and Federal Reserve announcement is scheduled for the 20th. Going forward the markets are expecting the chance of a rate hike late this year, followed by cuts mid next year. https://www.cbc.ca/news/business/bank-of-canada-deliberations-1.6919589

The continued surprising economic resilience in North America, with the continued strong job market and sustained consumption, shows that the impact of the past prolonged accommodative monetary and fiscal policies is still evident. However, turning point signs are emerging. We are seeing the number of jobs per unemployed person in the US ticking up over the last few months and excess savings, accumulated in the wake of the pandemic, becoming depleted. This backdrop should reduce consumption. Leading indicators, headlined by the continued inverted yield curve, continue to suggest an impending economic slowdown, despite the recent resilience to warning signals. This, as well as the bulk of rate resets on consumer (ie. mortgages) and company fixed rate debt still to come, and current high valuation of US equities vs the rates that bonds are offering, warrants that our defensive stance to investment portfolio positioning remain unchanged. unemployed per job opening us leading indicators StatsCan July Jobs BLS July Jobs

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments