Last Month in the Markets: September 1st – 29th, 2023

What happened in September?

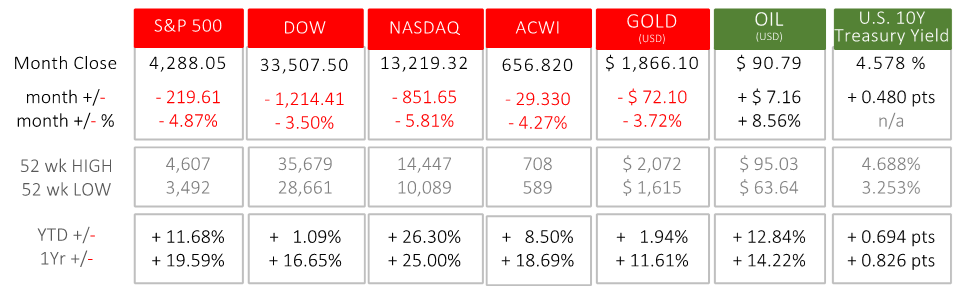

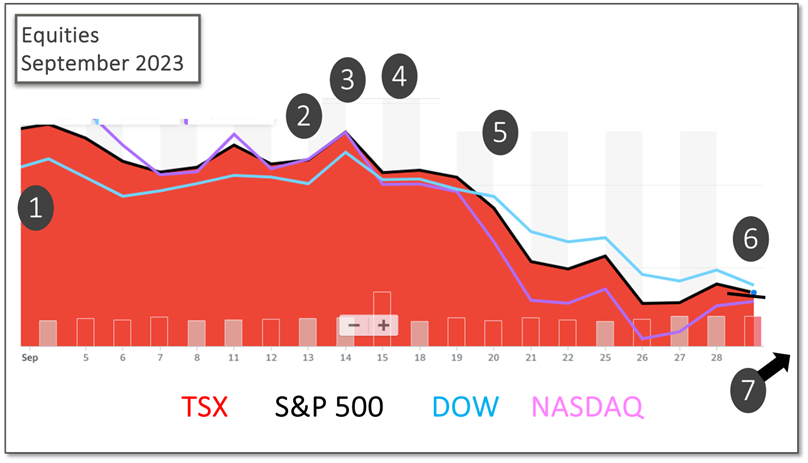

It was a difficult month for investors, as major indices globally lost value, as did gold. Industrial Metals, Oil and U.S. treasury yield were the only parts of the market that saw increases. The narrative for interest rates being kept “higher for longer” dominated market sentiment as the Fed signaled an intention to remain restrictive for longer and the US treasury ramped up debt issuance over the month. This was partially fueled by the inflation pressure from a continued oil price surge, which showed the WTI price climb to its highest level since July 2022. A deeper negative effect was seen on growth-oriented parts of the market, such as the technology heavy NASDAQ, which is relatively overweighted to companies whose valuations are based more on future earnings potential.

Internationally, the UK 100 index, with it’s overweight in energy and defensive names, managed to partially insulate from the global sell off, ending down less than 1%. Asian indices lost comparable value to North American markets, with the continued lack of a meaningful Chinese economic recovery. However, despite the usual high positive correlation between China and industrial metals, they managed to end the month flat. Bloomberg Industrial Metals Index

Gold, which usually has a negative correlation to interest rates, also lost value, while the US dollar, which is seen as a safe haven in times of market stress, appreciated against most major global currencies. This was also fueled by the relative resilience of the US economy and continued rise in US interest rates.

Several notable developments happened in September:

September 1st

The month began with the release of a strong U.S. employment report that showed 187,000 nonfarm payroll jobs had been added in August, and the unemployment rate rose to 3.8%. Employment trended upward in health care, leisure and hospitality, social assistance, and construction, and declined in transportation and warehousing. BLS release

September 13th

U.S. CPI rose 0.6% in August, after rising only 0.2% in July. “Over the last 12 months, the all-items index increased 3.7 percent before seasonal adjustment” according to the Bureau of Labor Statistics. Core inflation, which excludes food and energy, rose more than expected at 0.3% for the month. CNBC and August inflation BLS release CNN and August inflation

September 14th

The European Central Bank (ECB) increased its three key lending rates by 25 basis points. North American AND European equity indexes jumped-up on the news, and the Europeans leapt higher on a percentage basis (screen shot) ECB announcement

September 15th

The United Auto Workers (UAW) began a strike against the Big 3 U.S. car manufacturers for the first time walking out at all of them simultaneously. At the end of the month the UAW expanded its strike action further as the rhetoric from both sides continued. APNews and UAW strike

September 20th

At the latest monetary policy announcement from the Federal Reserve, Chair Powell stated, “recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated.” Consequently, the federal funds rate was maintained at a range of 5.25% to 5.5%. Federal Reserve announcement and press conference

September 29th

Released on Friday was the U.S. Federal Reserve’s primary inflation indicator, Personal Consumption and Expenditures Price Index. In August prices rose by 0.4% (down from 0.9% in June) in aggregate, excluding more volatile food and energy saw the index rise by 0.1%. This was the smallest monthly increase since November. The core PCE level is down from 4.3% in July and is at its lowest level in nearly two years. These levels were slightly below expectations, and the year-over-year annual increase for core PCE was 3.9%, which matched the forecasts.

The continuing improvements in the battle against inflation suggests that the Federal Reserve is nearing the end of its rate increases. The next interest rate announcement is scheduled for November 1st. BEA’s PCE release CNBC and PCE

September 30th

Markets continued to suffer from uncertainty whether a government spending bill would be successfully negotiated in the U.S. Congress. For the third week out of the last four, equities broadly lost ground. The trading-week had ended before a deal was reached in the House of Representatives on Saturday evening. It is a stop-gap measure, that extends spending for an additional 45 days after it is expedited and approved in the Senate and signed by President Biden just prior to Sunday’s 12:01 am deadline. CNBC and “shutdown” CNN and “shutdown”

What’s ahead for October and beyond in 2023?

After avoiding a U.S. government shutdown, the next important event will be the Federal Reserve’s interest rate announcement on November 1st, and likely the repeat of the threat of a government shutdown in mid-November unless another short-term stop-gap or longer-term funding bill is passed.

As we see central banks continue to try to strangle the economy with tight monetary policy, to bring inflation down to target, consumers continue spending and the labour market remains tight, so North American economies remains resilient. Meanwhile, as the market remained optimistic over the summer, we have recently seen a shift in these expectations, while fundamentals haven’t changed. As interest rates continue to increase, company earnings that an investor seeks to capture by purchasing a stock, over and above the rates you can obtain through taking less risk, becomes less appealing and are at a low compared to the last few decades. Additionally, chances of a recession continue as tight monetary policy works its way through the economy. Morgan Stanley

As we move forward, the market narrative should increasingly focus on the impact of tight monetary policy and less on how much rates will increase. Regardless of when this happens, the full impact has yet to be seen and is still only speculated about. Until we see this playout, defensive, yield bearing assets remain our recommended overweight.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments