Last Month in the Markets – April 3rd – 28th, 2023

What happened in April?

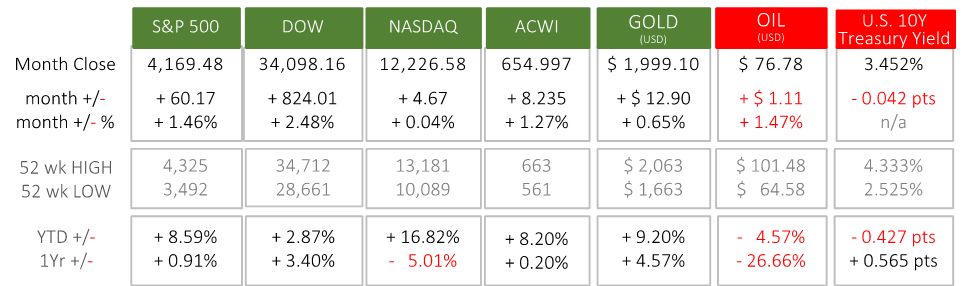

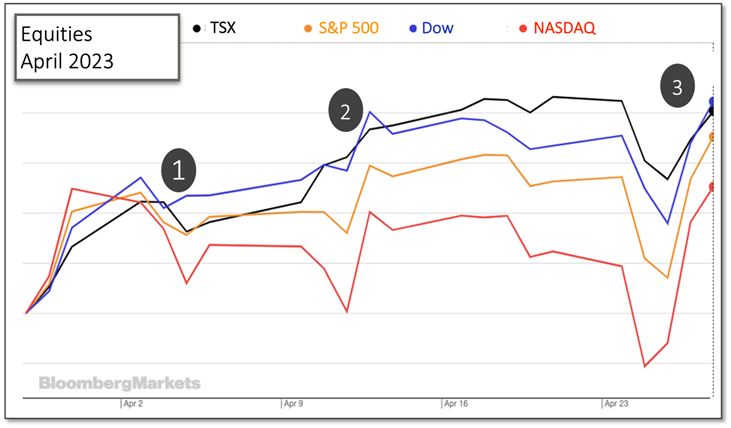

As banking concerns subsided, equity markets held up well during the month of April. The major North American indices remained relatively steady, with several events causing inter-month volatility. The NASDAQ finished the month where it began, but the TSX/S&P Composite and S&P 500 each increased by 1.5% and the Dow increased by 2.5%.

European and UK equities were the best geographical performers in April, with the MSCI Europe gaining 3.62%, and Chinese equities were the worst, with the MSCI China down 5.57%. These returns were partially explained by currency changes, with the British Pound gaining 1.9%, the Euro gaining 1.6% and China’s CNY decreasing by 0.06% vs the US dollar.

Gold and Oil ended the month slightly higher, gaining ground in the first half of the month on the back of surprise OPEC production cuts and then retracing most of those gains in the second half. Industrial metals declined this month, as they are heavily sensitive to Chinese economic activity. The price of Oil remains a large factor for inflation and its muted price action helped market optimism for central bank rate cuts.

Bond activity in Canada and the US ended the month with long-term bond yields declining and a narrowing of credit spreads, showing that investors see resilience in the economy.

April 2023 highlights:

1. Early in the month Federal Reserve Bank of Cleveland President Loretta Mester indicated that there was more upward movement needed in the Federal Funds Rate to quell inflation. This re-ignited fears of rising rates at the beginning of the month. Watch Fed President Mester here

2. At 8:30 am Eastern Time on April 12th the U.S. Bureau of Labor Statistics released consumer inflation data for March. Prices last month rose 0.1%, while the year-over-year CPI rate was measured at 5.0%. The rate remains stubbornly above the Federal Reserve’s target of 2% for annual price increases. The market reaction again showed a concern for continued monetary policy tightening. The belief that rates will rise again is not universally held at the Federal Reserve and the difference of opinion is contributing to market confusion.

a. About two hours later, the Bank of Canada (BoC) released its interest rate announcement. For the second consecutive time, the Bank did not change its policy interest rate, holding the target for the overnight rate at 4.5%. Bank of Canada projections have Canadian consumer inflation falling to about 3% in the middle of 2023 because of lower energy prices, improved supply chains, and restrictive monetary policy. BLS release Bloomberg and its Fed analysis BoC release

3. April 25th did not start well for equities. All indices dropped close to 1% in the first hour of trading. By the end of the month those losses had been reversed. Two key economic indicators were released in the U.S., the Gross Domestic Product (GDP) and the Personal Consumption Expenditures (PCE) price index. Total economic output, GDP, grew at an annualized rate of 1.1% for the first quarter of 2023, which is below most estimates. GDP grew at a rate of 2.6% in the final quarter of 2022. PCE, which is the Federal Reserve’s preferred indicator for inflation, rose 4.2% in March, down from 5.1% in February. This exceeded estimates of 3.7%. The result of these two items was a strong uptick for equities by the end of the week. While it is not as much as projected or desired, it does appear that the economy is slowing, alleviating negative sentiment. CNBC GDP & PCE BEA PCE release

What’s ahead for May and beyond in 2023?

Not much has changed in the past year since inflation began to grow dramatically and central banks began raising rates to lower demand. In hindsight, after a little more than a year of rate hikes and roller coaster rides for investors, North American stocks and bonds have landed essentially at the same levels as they were this time last year.

The path of inflation and efforts to control it will continue to have a large impact. On May 3rd the Federal Reserve raised the Federal Funds rate another .25%, bringing it to a band of 5%-5.25%. The consensus is that US rate hikes will now be on hold. Recent economic news for GDP, PCE, and CPI support this policy. With PCE at 4.2% and CPI at 5%, there is now a convergence of the US Federal Funds rate and inflation. CPI Federal Funds Rate

Despite market momentum of the first quarter and some signals showing economic resilience, the effects of tight monetary policy continue to cause a risk of stagflation and recession going into the second half of 2023. The current market momentum is likely linked to the expected support of interest rate cuts. Job openings per available worker remain low and inflation remains above target – lead by services inflation stickiness. Jerome Powell stated in his press conference after the rate increase that with the Federal Reserve’s current projections, they don’t see a rate cut happening in 2023. Mixed with a debt-ceiling dispute in the US and high household debt levels in Canada, as well as slew of leading economic indicators still flashing red; including the continued US government bond yield curve inversion and ISM new orders continuing to decline, a cautionary approach to investing is still warranted.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments