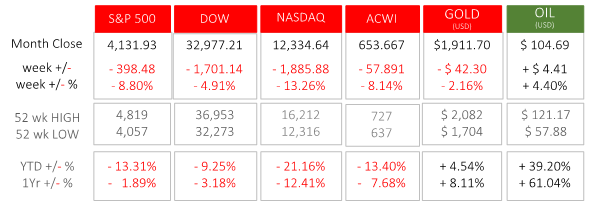

Last Month in the Markets – April 1st – 29th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in April?

The month began on a positive note for American equity indices, but unfortunately the high ended up being the first Monday of the month. With only a couple of exceptions, the remainder of April delivered continued downside for equity investors.

The Dow outperformed the S&P 500 and the NASDAQ last month and so far in 2022, graphs shown below. The TSX continues to outperform because of it’s heavy weight in commodities, and the technology-heavy NASDAQ has suffered from the continued trend of in-person work as pandemic restrictions are lifted.

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

The market landscape has changed more this year than in the two proceeding years. The 2022 narratives have continued through April:

- North American Central Banks continue their back stepping of accommodative policies. Interest rates are rising as inflation continues to rise, squeezing economic growth prospects and continuing their balancing act of reducing inflation without causing a recession.

- Russia’s invasion of Ukraine shows no signs of slowing and continues to cause supply chain disruptions, as well as a risk of a recession in Europe.

- The lockdowns in China are continuing to cause supply chain disruptions and threatening growth in the world’s second largest economy.

Chinese stocks had a late month rally due to a statement that the government will ease technology regulations and step up the support for the economy going forward. However, negative economic indicators such as weak domestic consumption, a sluggish housing market, a saturated online retail sector, and continuing covid lockdowns, provide uncertainty on whether this will be enough to lift the economy.

The Federal Reserve released the minutes from their mid-March monetary policy meeting that indicated committee members were taking an even more aggressive stance against inflation than originally thought. The Federal Open Market Committee members unanimously agreed to raise the federal funds rate .25%, and the market has priced-in an increase of about 170 basis points (1.7%) for 2022. The Federal Reserve will also allow close to $100 Billion in bonds to mature each month without being replaced. This will tighten long-term borrowing, increasing costs and yields. They have stated that with inflation expected to exceed 8%, the robust jobs market and strong GDP growth, the U.S. economy needs price stability and no longer requires monetary supports to fuel growth. FOMC Minutes

The U.S. Consumer Price Index (CPI) rose again last month. Since February prices for consumers rose 1.2% and in the past year prices have risen 8.5%. May 1981 was the last time the inflation rate reached this level. Like preceding months, the largest contributors were gasoline, housing, and food. Energy costs have risen 32% over the past year, and groceries are up 10% since March 2021. The Producer Price Index (PPI) for March sits at 11.2%, the highest year-over-year increase recorded for American companies. BLS CPI In Canada, Consumer price inflation exceeded expectations in March. Annual inflation rose to 6.7% last month, up from 5.7% in February.

What’s ahead for May and beyond?

The Federal Reserve announced its latest changes to monetary policy on May 4th. A half-point increase was approved, which has not occurred since 2000, as well as an announcement to shrink its balance sheet starting in June. The consensus among Federal Open Market Committee members, as indicated in past meeting minutes and the statement that they “anticipate ongoing increases in the target range will be appropriate” at the May 4th meeting, suggests that multiple increases will occur this year and more .50% increases could be implemented over the next few months. The Bank of Canada isn’t scheduled to release its next interest rate announcement until June 1st.

Earnings season continues in the U.S. as May begins. So far earnings have been a mixed bag, with companies such as Netflix, Amazon, and Google bringing market disappointments and Facebook, Airbnb, and Starbucks surprising to the upside. Earnings are one of the short-term catalysts that could see a change in market sentiment.

Oil will likely continue to sustain its high price as the European Union plans to ban Russian imports by the end of the year.

The Bottom Line

We continue to keep a defensive stance in our portfolios. We are over weighting geographically advantaged regions, such as Canada, and maintain higher weightings in industrials, energy, and financials, and with a selective exposure to technology that ensures companies with sustainable business models, quality financials and reasonable valuations. On the fixed income side, we have focused our exposure to floating rate notes and inflation adjusted instruments to withstand the continued headwinds of monetary tightening and inflation. As underlying North American economic fundamentals are strong, such as consumer demand and employment, the focus is to withstand the current market uncertainty and headwinds listed above. Once these pass, we should see a renewed upward direction in equity markets.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service.Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments