Last Year in the Markets – January 3rd to December 30th, 2022

What happened in 2022?

Last year was trying for almost every investor. The difficulty affected every asset class at some point during the last twelve months, with the US dollar and crude oil being two of the few notable assets which ended the year on a positive note. This highlights how the causes were mainly centered around issues with inflation – driven partly by increasing energy prices and the aggressive tight monetary policies of central banks that followed. Tight labour market conditions and geopolitical issues exacerbated the situation, leaving us in anticipation of a coming recession.

Looking back at the expectations going into 2022, the Federal Reserve was projecting the Federal Funds rate to stay below 1% and inflation to be under 3%, how things turned out differently. CNBC

The equity markets reversed their direction 9 significant times throughout the year. Here are the highlights:

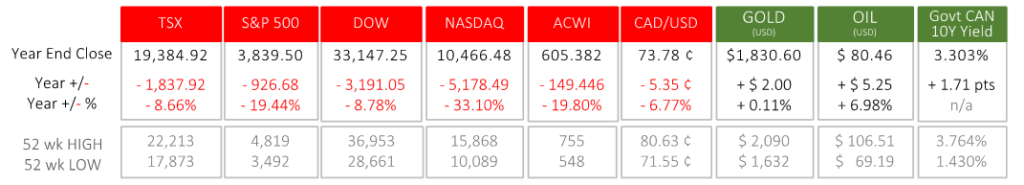

- The S&P 500, Dow, and NASDAQ, peaked on the first trading day of the year, January 4th, and dropped by 19%, 9% and 33%, respectively, by year end. The TSX, helped by its concentration on commodities, delayed its peak until late March and early April and still fell by nearly 9% in 2022. https://www.bloomberg.com/markets

- Russia invaded Ukraine on February 24th, providing foundation for the economic and humanitarian tragedy felt throughout the year. January 1st 2023 was the 312th day of the war. The Guardian’s daily war summary

- The primary inflation indicator for the U.S. Federal Reserve, the Personal Consumption Expenditures (PCE) price index for February was released at the end of March. Consumer prices were rising at an annual rate of 6.4%, a level not seen in more than 40 years. https://tradingeconomics.com/united-states/pce-price-index

- April’s Consumer Price Index (CPI) edged downward providing lift to equity markets as year-over-year inflation rate fell to 8.3% from 8.5% in March. Prices rose 0.3% in April. BLS CPI

- The anticipation for the Fed’s interest rate announcement on June 15th was negative, and when May’s rising inflation, 8.6% year-over-year, was announced the markets began pricing-in a large increase to the federal funds rate, which was eventually 75 basis-points. BLS May inflation Federal Reserve announcement

- The release of U.S. employment data provided some respite from the fears of recession as the American economy continued to generate jobs at a robust pace. 372,000 jobs were created in June 2022 and the unemployment rate remained unchanged at 3.6%. BLS employment situation

- The minutes of the Federal Reserve’s Federal Open Market Committee were released. The meeting notes indicated that members of the committee believe that interest rates must be much higher than originally projected to reduce inflation to acceptable levels. FOMC Minutes from June meeting

- Consumer inflation exceeded expectations and remained well above the Fed’s target of 2%, suggesting that rates will be increased substantially again, potentially triggering a recession. The CPI for September, released on October 13th, was 8.2% on a year-over-year basis. Prices rose 0.4% in September compared with an increase of 0.1% in August. BLS September inflation

- The Federal Reserve’s FOMC raises benchmark interest rates by 50 basis-points. Federal Reserve press release

- After two consecutive years of annual gains during a pandemic the major indices lost value in 2022.

This year highlights a complete reversal from the “let’s earn as much as possible” excess sentiment of later 2020 and 2021, stressing the importance of maintaining a diversified portfolio and a goals-based approach to managing risk versus reward.

What’s ahead for January and beyond in 2023?

While we saw some positive sentiment out of China as they relaxed their Zero Covid policy, we ended off 2022 with the Federal Reserve reiterating keeping a restrictive stance into 2023. Goods inflation has been decreasing steadily as supply change bottle necks ease, food prices remain below their recent highs, and concerns about the global economy dragged down energy prices in December. While we are continuing to see cracks in service prices and wage growth, they remain high. We have also seen signs of deglobalization over 2022, which if continue will keep the inflation rate elevated. These factors will likely keep central banks raising rates into the next two meetings, although at a slower pace. Right now, the consensus is around 5% being a potential peak for US interest rates. The Bank of Canada is in a similar position. Potentially we will see another, smaller rate hike in January from them but they hinted they are getting close to the end of their tightening cycle as well. Bloomberg reuters

After this, the outlook remains highly uncertain. Optimistically we could see inflation decelerate rapidly, labour markets cool down and central banks following suit with rate cuts getting into the second half of 2023, Russia and Ukraine make headway with conflict resolution talks, and the positive momentum in the Chinese Economy seen in December continues. If this happens while consumers remain resilient, we could avoid a recession. On the other hand, we could see negative progress on these fronts and could be driven further down the recessionary path. We are in wait and see mode as we look for further clarity. Regardless, the headwinds will eventually pass, and we will see a return to upward markets. Until then, keep focused on your long-term goals and proper risk management. As always, please reach out to us if you’d like help with your investments and financial planning.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments