Last Month in the Markets – June 1st – 30th 2023

What happened?

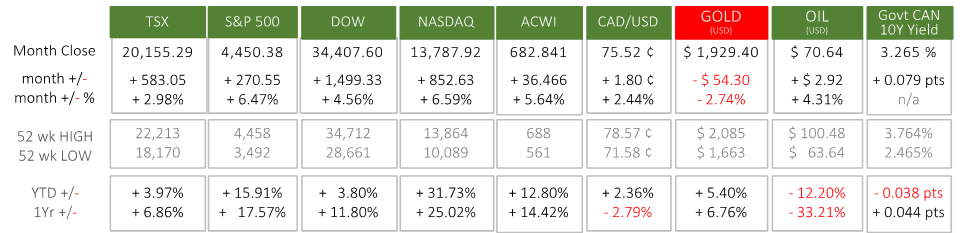

June was an eventful month for investors, with equities experiencing significant growth. The heightened momentum contrasted with the relatively slower pace observed in the preceding months of the year. For example, the TSX is up 4% in 2023 with 3 quarters of that gain occurring last month. The Dow Jones Industrial Average rose by 4.5% last month, bringing its year-to-date performance close to 4%. It’s also notable that previous gains this year have been concentrated, coming from a basket of large cap tech stocks, but June’s rally in US equities expanded the breath and encompassed all 11 sectors.

Globally, the US showed the largest returns, but the rally extended across all the major regions except for the Chinese domestic market. This was due to concerns that stimulus measures implemented by Beijing might not be sufficient to drive a significant recovery in the Chinese economy. Although there has been a slight increase in industrial commodity prices, which are closely tied to the Chinese economy, the gains have been relatively small.

On the fixed income side, global sovereign bond yields rose last month, as major central banks continue to maintain tight monetary policy, including a stance on further increasing interest rates. The yields on US 10-year Treasuries reached their highest level since the banking turmoil in early March.

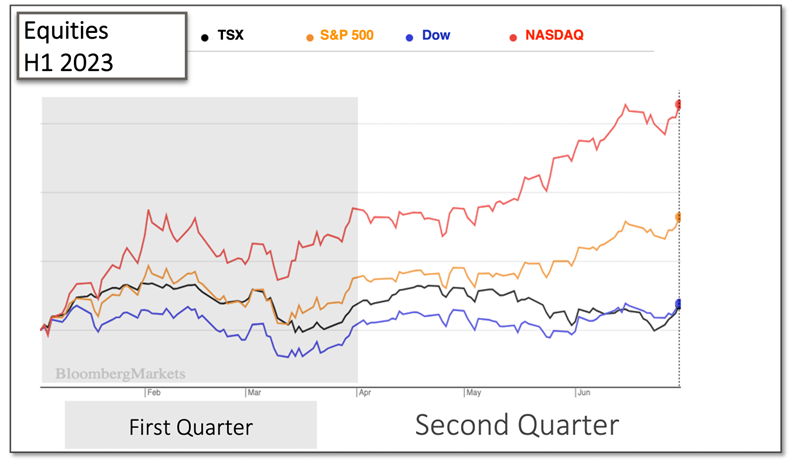

Year to date the NASDAQ has been the clear winner among indices, posting a jump of nearly 32%. The S&P 500 increased 15.9% over the past six months, roughly half the growth of the NASDAQ. The 30 major corporate constituents of the Dow Jones index rose 3.8%, slightly lagging the TSX’s 4% increase.

Despite aggressive interest rate hikes by central banks, the gains seen so far in 2023 can be attributed to the speculation of growth due to AI and an unexpected resiliency in North American economies. Stemming from excess household savings and structural factors for housing, we have seen a continuation of strong consumption demand, especially for services and residential real estate, as well as a tight labour market.

What happened over the month of June?

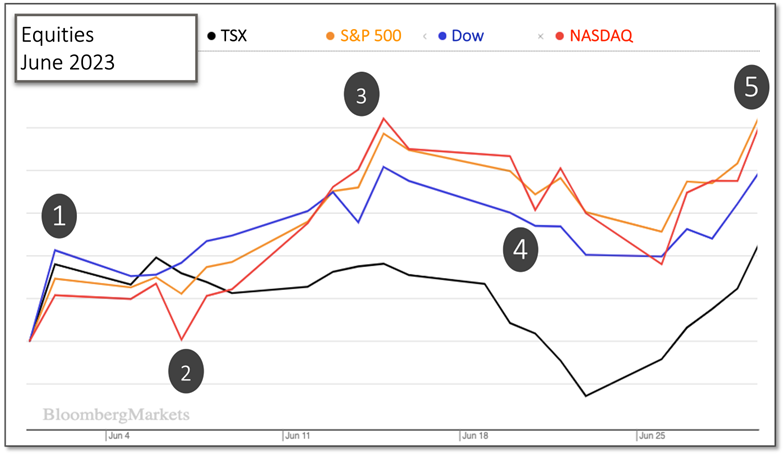

During the month, several significant economic events had varying impacts on the Canadian and American markets, with most influences originating from the United States, as is often the case.

- June 2nd – The month began with good news as the U.S. jobs market continued its strong growth when nonfarm payroll increased by 339,000 in May. This is more than March and April’s employment increases of 217,000 and 294,000, respectively. The average monthly gain in employment over the past 12 months has been 341,000, showing that job growth has returned to more robust levels. Unemployment rose 0.3% to 3.7% despite improvements in the services, construction, healthcare, transportation, government, and warehousing sectors.

- June 6th – The Organization for Economic Cooperation and Development (OECD) reported April consumer inflation at 7.4% for its 38 member countries. Inflation had been 7.7% in March as 27 countries reported a decline, but inflation exceeded 10% in 10 countries and surpassed 20% in Hungary and Turkey. The OECD projects global growth at 2.7% this year, 2.9% in 2024, which is below the 3.4% average growth seen in the seven years prior to the pandemic.

- June 9th – Canadian “overall employment was little changed in May, as employment fell by 77,000 for youth aged 15 to 24 and it increased by 63,000 among people aged 25 to 64” according to the latest data from StatsCan. Despite the small gain in total employment, growth has moderated suggesting that this economic indicator is heading toward neutral or negative territory.

- June 13th – The Bureau of Labor Statistics released U.S. inflation data for May showing consumer price increases of 0.1% in May and year-over-year of 4.0%. Prices had risen 0.4% in April, and May’s annualized inflation rate was the lowest since March 2021.

- June 14th – The Federal Reserve made its latest interest rate decision, holding rates steady, and markets reacted mostly favourably. The pause in interest rate increases is expected to be temporary according to the information released with the announcement since the 2% inflation target has not been reached. Simultaneous to the interest rate announcement was the release of the Fed’s Summary of Economic Projections, which contains the dot-plot, which collects the individual opinions of Federal Open Market Committee (FOMC) members for upcoming interest rates. The FOMC members project that interest rates will rise into 2024 before falling slightly, and lower rates in the 3 to 3.5% range will arrive in 2025.

- June 21st – Jerome Powell during his testimony to the House Financial Services Committee stated, “The process of getting inflation down to 2% has a long way to go.” Powell’s support for additional rate increases tempered market enthusiasm from the earlier rate pause.

- June 30th – The Bureau of Economic Analysis reported the Personal Consumption and Expenditures price index rose by 0.1% in May after rising 0.4% in April. The PCE is a primary inflation indicator for the Federal Reserve. Powell also made an announced in Madrid, where he indicated expectations of slower rate increases.

Overall, each announcement had its share of negative elements, but generally resulted in an upswing for the markets.

What’s ahead for July and beyond in 2023?

The battle against inflation will continue to be waged while the resiliency of major global economies continues. Demand has been strong and only recently shown signs of easing. After the banking turmoil earlier this year, central bankers believed that the credit market stress would lead to stricter lending conditions and a drastic change from central bank’s hawkish rhetoric. However, the situation has improved quickly, and with it has prolonged the monetary tightening from what was expected a few months ago.

The next interest rate decisions from the Bank of Canada, Federal Reserve and European Central Bank are July 12th, 26th and 27th, respectively. They will continue to keep economic strength in the forefront to their decisions. Subsequent decisions are not scheduled until mid-September.

The continued hawkishness of central banks poses an upside risk to bond yields in the near term but as inflation continues to moderate, this will likely create an upper limit. For equities, while we may see a short-term continuation of market rallying in coming months, headwinds remain. The underlying economic narrative we have been grappling with since the beginning of 2022 has not been resolved. While normally a resilient economy is a positive sign, under the current circumstances of sticky inflation, it only prolongs pressure from central banks. This increases the likelihood of the tug-a-war ending in a recession. Recent expansions in company valuation multiples caused by the June rally show a further lack of pricing-in for a recessionary scenario. Additionally, because of the rise in interest rates, the earnings yield on equities has now declined to the same levels as less risky investment grade bonds and cash, making it harder justify the risk of holding them. Because of these factors, it is still prudent to maintain defensiveness in an investment portfolio.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments