Last Month in the Markets – January 3rd to 31st, 2023

What happened in January?

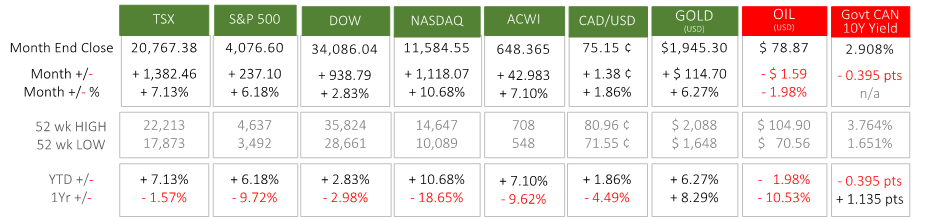

Last month proved to be very optimistic and the main equity indexes all increased significantly. The Dow, which only increased by 2.75% in January, was the weakest performer. The TSX and S&P 500, which cover a wider range of industries, increased by 7% and 6% respectively. The technology-focused NASDAQ increased by more than 10%. Eurozone stocks provided an outperformance surprise, as milder than anticipated weather and fiscal support led to a calming of energy crisis fears and higher-than-expected GDP growth in 2022. China has also showed strong expected economic momentum following it’s re-opening in December.

The bond market saw a significant rebound, with investment grade and high yield corporate bonds outpacing global government bonds. A big part for this was due to cooling inflation pressures, as the December US inflation rate came in at 6.5%, down from 7.1% in November, and Canada inflation went from 6.8% to 6.3%, mostly due to a drop in energy prices. This pushed further expectations that central banks are nearing the end of their tightening cycle. CBC

Almost every major asset class had a positive month, with the notable exceptions of crude oil and the US dollar.

Only a few days during January didn’t deliver positive gains, and each of those were associated with legislative and economic events in the United States:

- January began with the U.S. House of Representatives unable to elect a Republican Speaker of the House. The negotiations and debate lasted longer than any election in over 150 years. Kevin McCarthy finally prevailed, but with speculation he gave up too much control.

- Just after mid-month, equities dipped as the U.S. debt ceiling reached its limit. The Department of the Treasury took extreme actions to keep the federal government operating. These included suspending new investment in retirement and healthcare funding for the Civil Service Retirement and Disability Fund and the U.S. Postal Service Retiree Health Benefits Fund, sales of State and Local government treasury securities, and re-investments in the Exchange Stabilization Fund. extraordinary measures

- The last day of January saw a dip due to the upcoming Federal Reserve interest rate announcement on Wednesday, February 1st. Since the last monetary policy release, the Fed has steadily maintained its commitment to controlling demand-driven inflation. The markets have wavered between accepting economic “good news” for Gross Domestic Product and jobs at face-value and interpreting the good economic data as “bad news” because it would potentially fuel inflation and the Fed’s tightening stance.

What’s ahead for February and beyond in 2023?

The Federal Reserve took another step toward in controlling inflation on February 1st by raising the federal funds rate by the expected 25 basis points, to a range of 4.5% to 4.75%. Jerome Powell stated that we are seeing positive signs of reduced inflation but that the labour market is still tight, and inflation excluding food, energy and housing remains strong. Reiterating they would stay on their path until the job is done. Powell’s Press Conference Transcript

Nevertheless, the market took his somewhat more subdued tone as a confirmation of January’s optimism and the rally has continued into February. However, since central banks haven’t moved from the stance that they will continue until inflation is in the realm of their 2% target, we should be expecting either a soft landing or a recession until we see an actual change to policy. Until we see further clarity on which of the two scenarios will play out, expect continued market speculation marked by volatility.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments