Last Month in the Markets: February 1 – 29, 2024

What happened in February?

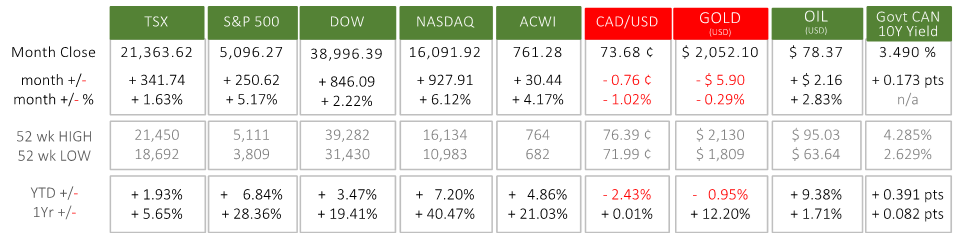

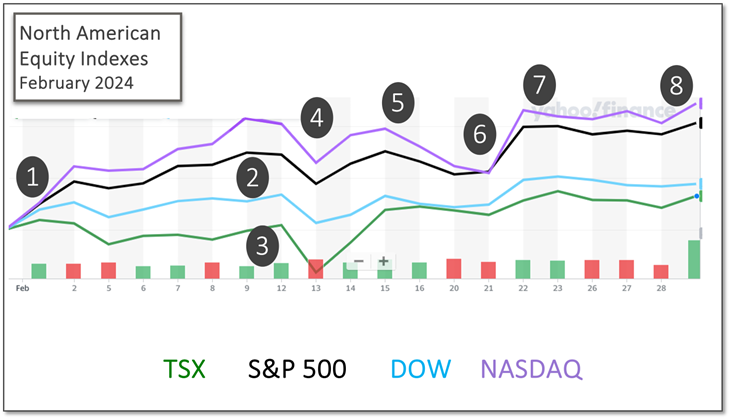

February brought another positive month for the global risk assets. In North America, Canada’s TSX rose over 1.5%, the Dow was up more than 2%, the S&P 500 extended by 5.2%, and the NASDAQ jumped 6.1%. The S&P 500 reached new record high levels eight times in February. We also saw market broadening, with smaller cap stocks also participating in the upside. The Russell 2000 was up 5.7% for the month.

While we are starting to see hints of market breadth, the market momentum since the beginning of the year has been in the hands of a few technology companies. The year-to-date gap in return between the magnificent 7 and the other 493 stocks in the S&P500 stands at 64.8% as of the beginning of March.

International markets rose along side North America. European markets, represented by the Euro Stoxx 50 index, gained just over 5%, and the Japanese market, represented by the Nikkei 225 index, rose 1.3%. Emerging Markets also had a good month, up for 4.8%, mostly thanks to a heavy recovery in China.

The SSE index, representing stocks traded at the Shanghai Stock Exchange, bottomed from an almost one year down trend on February 5th and staged a bounce of close to 10% over the month of February. This was due support policy. The People’s Bank of China cut its five-year loan prime rate the most since it was first introduced in 2019. Chinese authorities also initiated policy that prevented major institutional investors from selling more shares than they buy in the same trading day and cracked down on quant trading. While economic and market support is likely to continue, it is still yet to be seen whether it will generate a meaningful economic recovery. This lack of faith can be seen in the price action of industrial metals, which are highly correlated to the Chinese economy and remained flat over the month. CNN

For other commodities, oil prices surged for the second consecutive month, extending their year-to-date increase to 10.2%. Gold prices remained relatively unchanged. Notable is Cryptocurrency had a very strong month, with Bitcoin increasing 45.9% and Ethereum soaring by 44.2%. This was mainly due to the launch of Bitcoin spot ETFs, making digital currency more easily accessible to the broader investor base. BNN

The resilience of the US economy remained a theme over the course of February. This was highlighted by hotter than expected inflation reports causing a continuation of unwinding dovish Federal Reserve bets, leading to further downside in treasuries prices and an increase in their yields.

Several announcements and events contributed to the rise overall rise in equity values over the month:

- January 31st – February 2nd

Events on the last day of January created a positive environment to begin February. The Federal Reserve held its benchmark interest rate, the federal funds rate, steady. At the press conference on January 31st, Fed Chair Jerome Powell said, “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that [lower rates].” Although not positive news, it aligned with market expectations. Fed release CNBC and rates

Canadian Gross Domestic Product (GDP) grew by 0.2% in November after three months of static performance. Goods-producing industries grew faster than the services sectors as 13 of 20 industrial sectors increased in November. The slight expansion in economic growth was welcome news for investors because modest growth supports the economy and easing of monetary policy. StatsCan release StatsCan and GDP

Total nonfarm payroll employment rose by 353,000 in January, the largest monthly increase since January 2023. BLS release CNBC and jobs

- February 9th

The S&P 500 gained over a percent as the broad-based U.S. index closed over 5,000 points for the first time in its history. As reference, the 4,000-point level was reached in April 2021. The gains were attributed under the sentiment that the Federal Reserve will be able to achieve a soft landing.

StatsCan released the latest data for the Canadian employment situation. January’s Labour Force Survey showed that employment increased by 37,000 after three months of little change. The unemployment rate fell 0.1% to 5.7%, the first decline in more than one year, as population grew slightly faster than employment. A CIBC senior economist suggested that the Bank of Canada “won’t be in a rush to cut interest rates, and we maintain our expectation for a first [interest rate cut] in June”, which had been a growing expectation. StatsCan release CBC and LFS

- February 13th

The Bureau of Labor Statistics announced U.S. inflation remained above target at 3.1%, being more persistent than the expectation of 2.9%. Prices rose 0.3% in January, higher than the 0.2% seen in December. BLS CPI release CNBC CPI and rates

- February 16th

The Producer Price Index rose 0.3% in January after declining 0.1% in December. It tracks the prices domestic producers receive for their output from customers and is a measure of insight into future consumer price levels. The increase may have been small but reflects the US economic resilience and sticky inflation. BLS PPI release CNBC and PPI

- February 21st

The Federal Reserve released the minutes of its latest interest rate meeting, showing concern that progress against inflation could stall. The areas of concern were consumer spending and business hiring. However, the minutes did include the statement “participants judged that the policy rate was likely at its peak for this tightening cycle.” Which shows conviction that rate cuts will come eventually. FOMC Minutes CNBC and FOMC Minutes

- February 22nd

The NASDAQ jumped 3% because of Nvidia, the U.S. computer chip manufacturer at the forefront of the artificial intelligence industry. Nvidia released an optimistic forecast of earnings that projected a threefold increase in quarterly revenue. Its fourth quarter revenue was $22.1 Billion, a 265% increase from Q4 2022. Nvidia’s share price jumped 11% on the day, and its value breached $2 Trillion and pulled the NASDAQ along with it. CNBC and Nvidia

In Canada, Inflation news dominated the economic releases. With a surprise twist apposing the U.S inflation numbers released on the 13th, the decline in the growth of the Consumer Price Index (CPI) surprised to the down side, rising only 2.9% on a year-over-year basis, down from 3.4% in December and below the expectation of 3.1%. Gasoline prices fell 0.4% in January, helping to slow inflation. Excluding gasoline, consumer prices rose 3.2% last month. Grocery prices remain above the aggregate rate of inflation at 3.4% but have lowered from December’s 4.7% level. Mortgage interest costs were the largest driver of inflation, increasing at an annual rate of 27.4% and housing rental costs grew by 7.9% on a year-over-year basis. StatsCan CPI release CBC and inflation

- February 29th

The Personal Consumption Expenditures (PCE) price index rose 2.4% in January, and core PCE (excluding food and energy) rose 2.8% on a year-over-year basis, and 0.4% in January. These levels were aligned with analyst expectations. Personal income grew 1.0%, which was well above the prediction of 0.3%. Despite the decline of inflation rate since central banks began raising rates, “hot January inflation data adds to uncertainty and pushes back rate cut expectations” according to economic strategist, David Alcaly, at Lazards. PCE and CNBC BEA’s PCE

The U.S. Congress passed another budget bill extending the government’s ability to continue to operate. This was the latest round in a four-part series of short-term solutions, that extends some government operations until middle of March and guarantees a fifth round of negotiations. The series of stop-gap measures is likely to continue since neither party seems willing to take the reputational damage of raising the debt ceiling permanently. CNN and spending bill CNBC and spending bill

What’s ahead for March and beyond?

On March 6th, the Bank of Canada held its policy interest rate unchanged. The overnight rate remained at 5%, the Bank Rate at 5.25%, and deposit rate at 5%.

The Bank of Canada’s next interest rate announcements are scheduled for April 10th, June 5th, and July 24th. The U.S. Federal Reserve’s scheduled monetary policy decisions occur on March 20th, May 1st, June 12th, and July 31st. According to expectations from CME’s FedWatch tool, interest rate reductions will not occur until June or July. CME FedWatch tool CBC and BoC rates

Although the path of inflation has not slowed sufficiently yet to allow central bankers to lower rates, globally we are getting closer to seeing the possible end to this cycle. Slowing growth in Canada, Japan and Europe, and in even deflation in China, continue to provide the case for a coming monetary policy easing.

The road back to normalization in the US continues to be a bump one with the slowing pace of inflation diminishing after some steady months of downside surprises, even with Canada continuing to surprise to the downside. Service inflation in the US remains the hurdle to over come but while shelter costs and wage growth remain elevated, they have continued to come down from their peak.

We move forward still being unclear of whether the Federal Reserve will achieve a soft landing or if there will be a no landing scenario for some time. The market is pricing in expectation of a positive resolution. The US economy continues along with surprising resilience but excess savings is further dwindling, restrictive monetary policy is continuing its impact, and while AI is generating profits for some companies, market euphoria has driven their valuations to expect perfect execution. There is long term potential in AI but it is still in its integration phase and has yet to show a broad positive impact on productivity. We are keeping our exposure to income and defensive equity positions and continuing to focus on quality holdings.

Luke Demjen is an Associate with Aligned Capital Partners Inc. (“ACPI”). The opinions expressed are those of the author and not necessarily those of ACPI. This material is provided for general information and the opinions expressed and information provided herein are subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on the information presented, please seek professional financial advice based on your personal circumstances. ACPI is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and the Canadian Investment Regulatory Organization (“CIRO”). Investment services are provided through Qopia Investments, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/Qopia Investments and covered by the CIPF.

I obtained my Economics Degree from the University of Calgary and have over 10 years of experience as an investment and lending advisor with one of the Big 5 banks in Canada. In 2018, I obtained the Chartered Financial Analyst (CFA®) designation, the premiere investment analysis distinction in the financial services industry. My academic knowledge, along with my experience and insights into the banking system and capital markets help make sure I put my clients savings to work and have them financially prepared to meet all of life’s goals and milestones. I am passionate about making sure my clients receive the industry’s best in financial advice and attention.

In my spare time I enjoy performing martial arts as well as skiing, making music, and soaking up new experiences with friends and family.

Recent Comments