Last Month in the Market (March 1st-31st, 2022)

What happened in March?

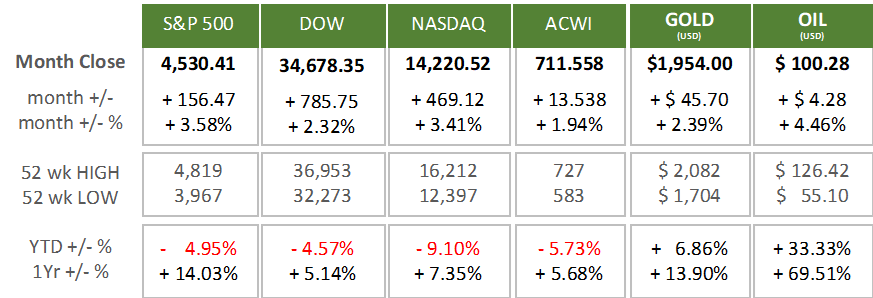

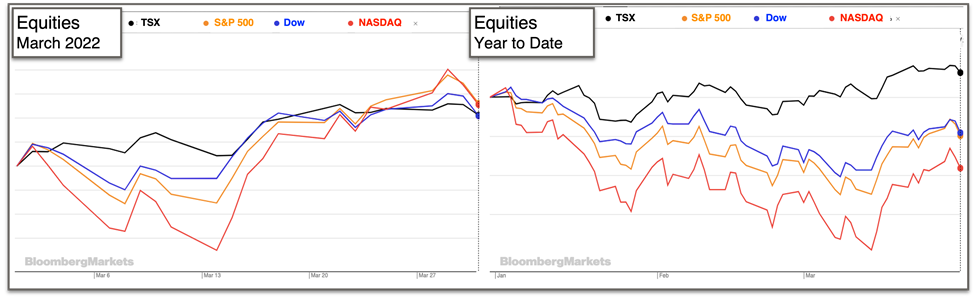

For the fourth consecutive month North American equities dipped mid-month and then recovered. The North American indices performed well gaining 2 – 4%. However, they are all still in negative territory for the year. All indexes follow the same pattern in the Year-to-Date graph below, but at differing levels of performance.

Gold and oil continued to rally into the first 8 days of March, from the onset of the Russian invasion, before giving back most of the gains on the second half as the markets adjusted the level of panic, finishing slightly positive. The Russian/Ukraine war and the re-locking down of China has continued to disrupt supply chains, exacerbate inflation, and further create overall market uncertainty. This has been encouraging for gold, which is seen as a safe haven. The steady escalation of sanctions and embargos on Russia, which is the world’s third largest producer, put further pressure on the price of oil.

U.S. Employment numbers in February have been encouraging. Employment rose by 678,000 jobs and unemployment fell to 3.8% according to the U.S. Bureau of Labor Statistics. 6.3 million people remained unemployed in February compared with 5.7 million unemployed and an unemployment rate of 3.5% two years prior, in February 2020. The rate of labor force participation (the number of employed plus those seeking employment) continued to be the major dragging factor. BLS.gov Release

The inflation story is getting worse. The U.S. Consumer Price Index (CPI) rose 0.8% in February and 7.9% over the past 12 months (before seasonal adjustment), before the economic effects from the Ukraine invasion had begun. The two most significant contributors being Food (7.9%) and Energy (25.6%). Excluding these, prices rose 6.4%, the largest 12 month change for the category since August 1982. In Canada, consumer prices increased 5.7% year over year, up from a 5.1% gain in January. This has been the largest gain since August 1991. BLS CPI

The Federal Reserve continues to be stuck in the tough spot of trying to control rampant inflation without tipping the economy into a recession, which is becoming a harder balancing act. They have been increasing their stance on how aggressive they need to be with the speed and amount they will hike interest rates and reduce bond purchases. In the middle of March, the first federal funds rate hike was approved, raising from .25% to .5%, with a consensus that officials would have preferred a higher (.5%) increase. At the time of the announcement, as many as six rate increases are expected from the Fed in 2022 and they are expected to start reducing their bond holdings as early as May. Federal Reserve Announcement

Federal Reserve policy has furthered steep declines in bond prices over the month and a continued to flatten the government bond yield curve (shorter term bond rates are going up faster than longer rates). Equity returns have consistently preformed better in a flattening environment than a steepening one, but an inverted yield curve (short term interest rates become higher than long term interest rates) is considered an indicator of a coming recession; so the flattening is being closely watched.

The European Central Bank met in Frankfurt and announced their latest policy to address continental consumer inflation and the crisis in Ukraine. Bond buying will end this summer, most likely leading to interest rate increases. ECB Statement

What’s ahead for April and beyond?

Much of the news over the next while will focus on the geopolitical and economic effects of Russia’s invasion, with a side note on how Chinese lockdowns progress. The questions regarding the continued supply of Russian oil to Europe and the hunt for alternatives will continue to develop. The on-going costs of military spending will continue to weigh on government budgets, and supply chain disruptions will weigh on inflation concerns. In the shorter term, the indirect impacts of the war will continue to be felt in energy, agriculture, metal, and other specialized material prices.

The next opportunity for the Federal Reserve to increase interest rates occurs on May 4th, as discussed above, their stance will most likely be for larger and faster interest rate increases and bond reduction. Investors will keep an eye on how this will impact economic growth, with a key indicator being a sustained inversion of the US government yield curve.

Bottom Line

While it’s tempting to get wrapped up in the noise, a long-term focus on your financial goals should stay at the forefront. The war is a humanitarian tragedy, but the international community has a solid footing to shake off the economic effects after the conflict ends, even though regional impacts will linger. Looking past the shorter-term headwinds, the underlying macro-economic environment remains robust, with company profits continuing to grow, and the resulting stock valuation discounts we are seeing will pave the way for good returns once they pass. Our model portfolios have a focus on quality equities; with good financials, resilient business models, sustained strong profit generation, reasonable valuations, and we are avoiding volatile regions, where the current risk outweighs the return potential. Additionally, we have protected our fixed income assets from rising interest rates through duration protected vehicles, such as floating rates. If you have any questions, please reach out to a member of the Qopia Financial team.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service.Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.