Last Month in the Markets – June 1st – 30th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What Happened in June?

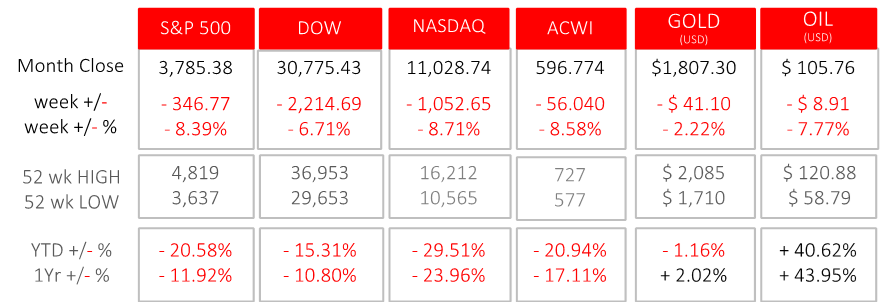

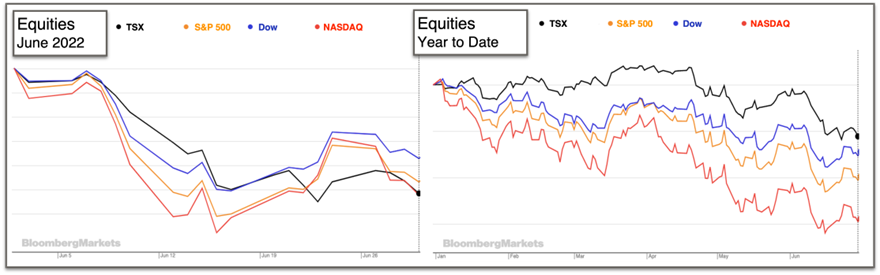

June was one of the most negative equity one-month periods in North American history. The broad based S&P 500 lost more than 8.4% of its value, the Dow dropped by 6.7%, and the technology heavy NASDAQ gave back 8.7%. The first half of the month saw the major drop, with a slight rebound in the second half.

The major indices have lost 11% to 29% over the past six months, and 6% to 23% over the

past year. The S&P 500, providing a balanced view of American Equities, officially reached a bear

market level, losing over 20% from it’s high on June 15th.

International markets also suffered the heavy drop in the first half of the month, except for China, with its

major indices ending positive. This was due to eased pandemic restrictions and with a lower price pressures,

authorities are continuing monetary and fiscal stimulus, supporting an improved economic outlook.

Gold held its value compared to one year ago even after losing more than 2% in June. Oil, like most

other commodities, has given back some of its value, but remains well ahead of the start of this year and

year-over-year.

(source: Bloomberg https://www.bloomberg.com/markets, and ARG Inc. analysis)

Recently the labour force participation rate has heavily influenced the US economy. With a tight labour

market being a factor that has exacerbated inflation, caused by many people not wanting to

return to work after Covid-19 setbacks. We are seeing positive signs now that this could be reversing. In June, May figures were announced that 330,000 people rejoined the labour force and

390,000 jobs were added. This could show a counter effect from the rising wage pressures we have seen

in recent months. The elimination of pandemic restrictions and government support is also contributing to the return of workers. The overall U.S. unemployment rate remained unchanged at 3.6%, a historically low level. BLS Announcement.

The storm of supply chain bottle necks and pent-up re-opening demand continues and Inflation

continues it’s upward trajectory. The U.S. Consumer Price Index (CPI) rose 1.0% in May from April,

adjusting for seasonality. The annual inflation rate sits at 8.6%. Again, the sub-indexes for food and

energy were major contributors to the overall inflation rate. The rise of these two categories is

significantly higher than the increases experienced in April. The inflation rate for “all items less food and

energy” rose 0.6% in both April and May. This flattening was a small measure of positive news. We have

since seen the momentum of oil drop in the latter half of June on economic growth worries. That, along

with a decline in shipping rates, and a continual shift from demand for goods to demand for services,

shows to be positive that inflation will moderate. BLS release

Consumer inflation in Canada rose in May to 7.7% year-over-year, an increase from the April year-over-year level of 6.8%. On a monthly basis inflation rose 1.4% in May, more than double the monthly increase of 0.6% experienced during April. StatsCan inflation

Inflation is not just a North American problem. In 16 of 44 advanced economies, the rate of inflation in

the first quarter of 2022 has quadrupled compared to Q1 2020. In stark contrast is China’s CPI of 2.1% for

May, which has been heavily influenced by strict Covid-19 controls. The modest price pressures are

allowing China’s Central Bank to release more stimulus to prop up the economy. In contrast, the European

Central Bank left it’s interest rates unchanged last week, but intends to raise them by .25% in July. China

inflation article ECB Pew Research

The Federal Reserve raised the federal funds rate by .75% on June 15th, raising the bar on their initially

telegraphed move of .50%. An increase of this magnitude had not occurred since 1994, signifying the

severity of the situation. The rate now lies in a range from 1.5 to 1.75%. At the press conference to

announce the increase, Federal Reserve Chair, Jerome Powell, reiterated the Federal Reserve’s stance to

do what was necessary to curb inflation, and stated that the Fed, “anticipates that on-going increases in

that rate will be appropriate”. To-date in 2022 the Fed has increased the rate by 1.5%. The median

projection by Fed Governors predicts that the federal funds rate could be 3.4% by the end of this year.

What’s Ahead for July and Beyond?

The second half of 2022 should provide more promise, even as the factors contributing to pessimism for

corporate performance and declining share values remain. Inflation will continue for several quarters, at

least until monetary policy and quantitative tightening work their way into the economy. Global supply

chain issues continue and have been exacerbated by the ongoing war in Ukraine. Although new threats

could emerge, a lot of the bad news has already been priced-in to the markets.

The non-farm payrolls data, which will be announced near the beginning of July, along with any progress

against inflation will heavily influence Central Bank actions and in-turn, the markets.

The Bottom Line

Patience and disciplined investing remain key. Keeping defensive in our equity strategy and keeping our

fixed income in floating rate bonds and short duration, we continue to stay firm through the market

turbulence. As the fear in the markets continue to price in worse scenarios, discounts are getting into

heavier territory. This continues to provide a higher chance of a positive surprise in inflation to catalyze

an equity rebound. While we don’t know when this will happen, we are getting closer to it. Until then,

stay patient and keep focused on your long-term goals.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory

Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered

to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for

informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the

author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without

notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation

and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the

information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related

business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising

in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the

above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related

business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising

in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the

above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally

offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not

constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future

returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior

consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and

expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed,

their values change frequently, and past performance may not be repeated”