Last Month in the Markets – February 1st -28th, 2023

What happened in February?

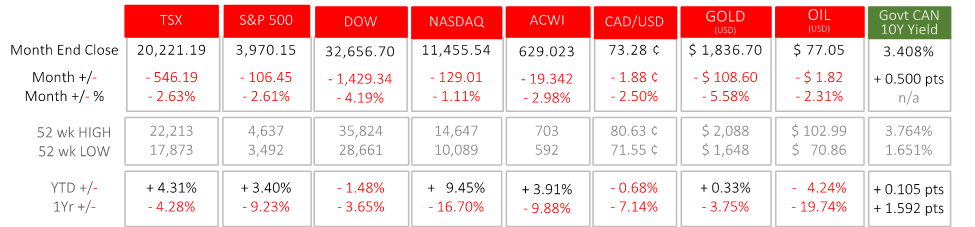

Coming off January’s broad base rally, led by lower-quality stocks, last month delivered mostly negative results. This was mixed with intermittent short-lived rallies, as people continued to speculate on in-coming central bank monetary policy. Canada’s TSX and the U.S. S&P 500 fell by almost the exact percentages of 2.63% and 2.61%, respectively. The Dow dropped an additional point and a half, finishing the month 4.19% below January’s close. The NASDAQ dropped a little more than 1%. The All-Country World Index (ACWI), which is comprised of 23 Developed Markets and 24 Emerging Markets and 2,882 constituents, lost 3% of its value last month. The negative returns were off the back of Investors’ focus shifting to signs of resilient demand and lingering price pressures which fueled concerns central banks will keep interest rates higher for longer.

The Canadian dollar slid against the American counterpart, and commodities followed downward. Bond yields, represented by the Bank of Canada 10-year note, rose again.

Each rally in February was stopped short when negative news caused an immediate reversal in indexes, here is a summary of what happened:

- The Federal Reserve raised its benchmark federal funds rate by .25% to a range of 4.5 – 4.75%, and made an announcement that confirmed further rate increases. The U.S. Non-farm Payroll Report showed that employment rose 517,000 in January with widespread gains. The unemployment rate was unchanged at 3.4%, mainly by a continuing catch up in the Leisure and Hospitality sector and a high demand in Healthcare. The strong jobs market suggests that interest rates have not sufficiently slowed the economy.

- The job market data weighed-down markets again. Federal Reserve Chair, Jerome Powell, stated: “The reality is if we continue to get strong labor market reports or higher inflation reports, it might be the case that we have to raise rates more”. Regarding the reduction of inflation with recession, he said, “There’s been an expectation that it’ll go away quickly and painlessly. I don’t think that at all guaranteed.” These statements reiterated existing policy will continue.

- Consumer inflation reversed its recent path by increasing in January more than it had in December, and year-over-year prices increased 6.4% according to the Bureau of Labor Statistics press release.

- On February 16th, Bank of Canada Deputy Governor, Paul Beaudry, reconfirmed the importance and commitment to the 2% inflation target. Stating that despite the pain inflicted by higher interest rates, stable and predictable prices facilitate better spending and investing decisions.

The remainder of February continued to be influenced by Canadian inflation, running at 5.9%, and an increasing US Gross Domestic Product in the fourth quarter. This has now caused market expectations for the Federal Reserve to go from one .25% rate increase and rate cuts in the last quarter of 2023, to a .75% rate increase by June and no cuts in 2023. This has increased bond yields, which has had a negative impact on stock multiples. This is due to an increase in the risk-free rate, which increases borrowing costs and is used for discounting company cashflows in valuation models. Further interest rate increases also mean further downside pressure on the economy, leading to worries about future earnings being hurt even more by the economic weakness.

Global Equities were not spared by the retracement. UK equities remained relatively stable, thanks to having a high weighting in defensive sectors. Chinese stocks experienced losses as the reopening trade fizzled out. This was highlighted by industrial metals performing poorly compared to other commodities. A lot of their demand comes from Chinese economic activity. Additionally, gold prices declined due to higher real interest rates and a stronger US dollar. The US dollar relative to other major DM economy currencies, after pulling back in January during the stock market rally, continued higher, highlighting its position as a haven asset.

What’s ahead for March and beyond in 2023?

Barring any unexpected economic shocks, like an escalation by Russia, the key influence on markets will continue to be the expectations and results of US and European Central Bank monetary policy announcements. We have seen in February that data points coming out, which are often contradictory, are met with a heightened market reaction, creating volatility. This will likely continue into March. The ECB and the U.S. Federal Reserve will announce their latest statements, which include interest rate decisions, on March 16th and 22nd, respectively. The Bank of Canada will precede both of those organizations with an announcement on March 8th.

Currently, the guidance from the ECB and Federal Reserve continues to indicate rate rises into the foreseeable future, albeit still smaller than previous ones. The Bank of Canada’s pause in rate hikes is in jeopardy based on recent commentary. Inflation continues to run above its target, and the interest rate increases to-date may have tempered inflation’s climb but have not brought price increases back into the target range of 2%. We are still in the later innings of the tightening cycle but are seeing signs of it extending longer than forecasted at the end of 2022.

BoC monetary policy Fed monetary policy ECB monetary policy

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.