Last Month in the Markets – August 1st – 31st, 2022

What happened in August?

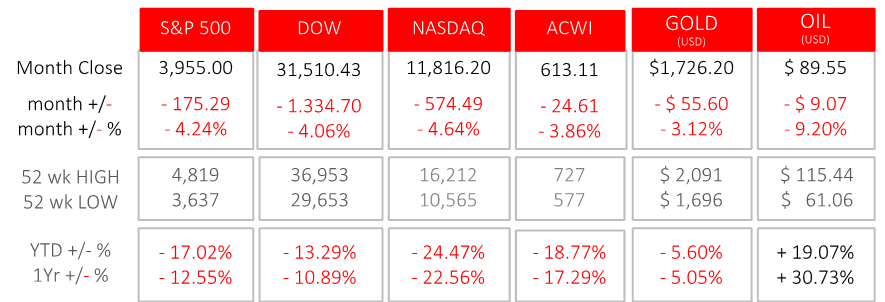

After the July relief rally, equities, represented by the major indices, peaked in the middle of the August. July’s rally extended into the first two weeks of August, from signals that inflation was easing, and demand was deteriorating, causing investors to bet that North American Central Banks would be forced to ease off on their interest rating increases. This was met with a full turn around when it became increasingly clear that the Federal Reserve remains committed to bringing inflation back to target, and the current economic signals aren’t enough to stop its trajectory. From their mid-month peak until the end of the month, the TSX dipped 4.6%, the S&P500 fell 8.1%, the Dow dropped 7.7% and the NASDAQ plummeted 10.0%.

Internationally, China’s announcement of stimulus was not enough to turn around economic conditions, falling short of the market expectations. The continuing energy crisis, a weak euro, increasing risk of a liquidity crunch, and poor company profitability weighed on Eurozone stocks. The All-Country World Index (ACWI) lost 6.5% of its value by month’s end from its August peak. Bloomberg & ARG calculations

Speaking at the Fed’s Jackson Hole Symposium on August 26th, Jerome Powell, the Federal Reserve Chair, outlined three lessons of the past that will be applied to the current inflation situation:

1. Central banks can and should take responsibility for low and stable inflation. Although the Fed’s actions only address the demand-side of the supply/demand imbalance that is driving current inflation, their responsibility is not reduced.

2. The public’s expectations about future inflation can play an important role in setting the path of inflation over time. The anticipation of high inflation can become entrenched in decision-making for businesses and households, because “inflation feeds, in part, on itself”.

3. The Federal Reserve “must keep at it until the job is done”. The Fed must act with resolve now by taking forceful and rapid steps to moderate demand, align it with supply and lower expectations of high inflation.

This was met with a continued negative reaction by equity markets, who had the expectation that the Federal Reserve would move forward with a gentler approach than what Powell outlined. Chair Powell’s full remarks can be found at Youtube Link .

Despite the clear and repeated steadfast stance of the Fed, economic data in aggregate for the month showed positive signs of a possible soft landing, coming in sluggish but not overly recessionary.

In Canada, the economy grew by 0.1% in June, 0.8% in the second quarter and an annualized rate of 3.3% during the second quarter. Household spending grew for services and semi-durable goods, business increased inventories, machinery and equipment and structures, while housing investment and durable goods orders declined. This was the fourth consecutive increase in quarterly GDP. StatsCan source

In the U.S, payrolls grew by only 132,000 in August according to ADP Research, the smallest gain since February 2021. The U.S. government released its official jobs data for August through the Bureau of Labor Statistics on September 2nd, showing that job growth slowed for the second month in August and came in below expectations. This shows economic cooling, as job offers fell while growth in filled jobs remained strong, on average. If this trend continues, it could lead to an easing in wage pressures, which would reduce overall inflation. This would help household purchasing power and further the case for less restrictive monetary policy. https://adpemploymentreport.com/

What’s ahead for September and beyond?

The range of possible scenarios going forward remains unusually wide. On a positive note, normalization of supply chains and price pressures seem to be on track, economic data is pointing more to a soft-landing possibility, U.S household balance sheets remain (assets – debt) in good condition. Wage inflation remains uncertain, but as highlighted above, it could show as temporary. On a negative note, the energy situation continues to worsen in Europe, natural gas and electricity prices have just recorded new highs; and China continued lockdowns loom, threatening to undermine supply chain normalization. Furthermore, even if inflation decreases, the possibility of it remaining above Central Bank targets through 2023 remains distinct, which the Fed has made clear will cause continued monetary policy tightening.

On an event note, the Governing Council of the European Central Bank (ECB) meets on September 8th to set monetary policy. The anticipated interest rate increase is 50 or 75 basis points. The Euro has lost ground against other currencies (12% down against USD) pushing the cost of imports higher, worsening inflation further. bloomberg.com

The next actions from the Federal Reserve will be the full implementation of its Quantitative Tightening program, to reduce its bond portfolio. In September, the Fed will lower its bond holdings by $16 Billion and another $13 Billion in October. These amounts represent the first time in the last three years that the total balance of the bond portfolio will be reduced. The reduction of supply will tighten the availability of funds and raise longer-term interest rates. Quantitative Tightening source

The Bank of Canada announced its latest interest rate decision on September 7th, a 75 basis point hike, in line with expectations. Consumer inflation data for Canada, the U.S. and Eurozone will be released on September 20th, 13th, and 16th, respectively. Each of the Central Banks will address its own inflation situation, and similar reactions are expected. The magnitude of the response may vary at these next meetings, but all three institutions are committed to returning inflation to target levels of 2%. ECB Rate Mandate FED Rate Mandate BOC Rate Mandate

The Bottom Line

As the uncertainty continues, we stay steady in our strategy. Ultimately, diversification and a long-term goal orientation remain the investor’s best allies. Reach out to us if you would like a hand in getting your financial plan and investments in order.

Qopia Investments is a trade name of Aligned Capital Partners Inc. (ACPI). ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Qopia Investments is registered to advise in securities and mutual Funds to clients residing in Alberta, Ontario, Saskatchewan, and British Colombia. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Qopia Financial.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15):“Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated”.